The following question is based on a question found in Hirsch and Louderback (1986: epbein Slime Industries

Question:

The following question is based on a question found in Hirsch and Louderback (1986:

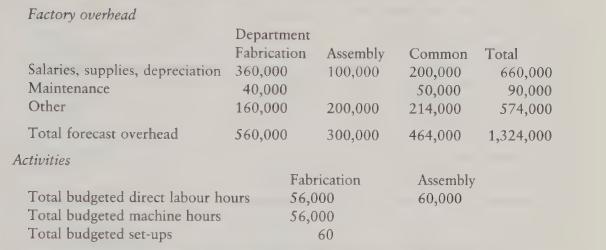

epbein Slime Industries Ltd is a job order company with two production departments. At the moment, Slime uses a single factorywide overhead rate based on direct labour hours. Mr Slime has asked you to show him how results would differ using departmental rates based on direct labour hours, and how they would differ if other bases were used to apply overhead instead of the current factorywide rate. Forecast results for 19X6 are as follows:

75% of maintenance costs in fabrication relate to set-up. Fabrication overhead is traceable and is related to machine hours.

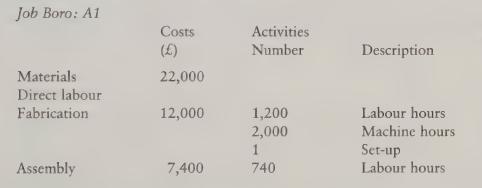

Mr Slime shows you the following data from a recent job. He asks you to illustrate various methods of dealing with overhead using this job as an example.

Required You are to assume that you are a member of the accounting staff of Slime and are to prepare a document addressed to Mr Slime in which you are to show the costs of Job Boro: A1, based on applying overhead using:

(a) A single factorywide overhead rate based on direct labour hours.

(b) Separate departmental rates, each based on direct labour hours as well as applying common overhead based on a factorywide rate based on direct labour hours.

(c) Various identified activity bases. Apply fabrication overhead, except for set-up costs, based on machine hours, set-up costs based on the number of set-ups, and both assembly and common overhead based on direct labour hours.

Step by Step Answer: