Thomas Ahrens, United Arab Emirates University and Christopher Chapman, Imperial College London Id love to know where

Question:

Thomas Ahrens, United Arab Emirates University and Christopher Chapman, Imperial College London I’d love to know where I am as an area manager. I don’t know what to do with food margin. Shall I say to my restaurant managers, well done? Thank you? You’re fired?

Hereford Steak Houses operated a chain of more than 200 wholly owned, full-service restaurants across the UK. Over the past 10 years the division had achieved substantial growth in revenues and earnings through the addition of new restaurants. More recently, however, with increasing numbers of new entrants to the UK eating-out market and the growing saturation of Hereford Steak Houses’ own outlets, senior managers were increasingly turning their attention to internal financial controls as a means to sustain earnings growth.

National branding and marketing for the chain was managed centrally by Hereford Steak Houses’ head office. Most significant to this was the nationwide menu that defined the food specifications, cost and price of all dishes for sale in all outlets. Menus were designed to deliver a target food gross profit margin that was agreed between the boards of Hereford Steak Houses and the corporate leisure group of which it was part and applied to all of Hereford Steak Houses’ outlets. While food cost was a primary element of restaurant controllable costs, as the above quotation from an area manager indicates, there was a lack of agreement on how the food margin reports should be used to evaluate a restaurant manager.

Restaurant managers emphasised that they wanted leeway to meet the demand of their local clientele.

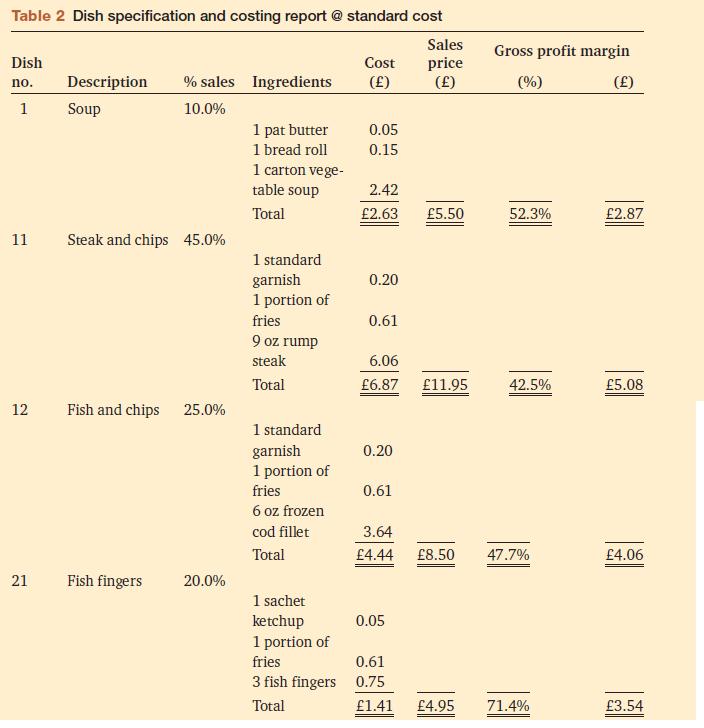

The gross profit margin was defined as sales minus cost of food used and was generally referred to as the ‘food margin’. For each new menu a selection of dishes was iteratively developed in order to achieve the target food margin (in terms of percentage and cash). This was a complicated process since the menu needed to contain dishes at a range of price points to appeal to different customers. Depending on the selling price, different levels of margin were realistic. For example, a very high margin on high-cost dishes resulted in unrealistic sales prices, but could be sustainable on low-cost dishes. High-volume dishes offered scope for the centralised purchasing department on negotiate substantial price discounts. Hereford Steak Houses’ position as a buyer of large quantities of food also allowed them to enforce strict quality standards for raw materials.

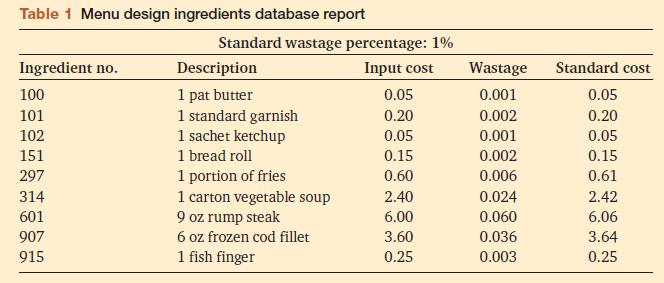

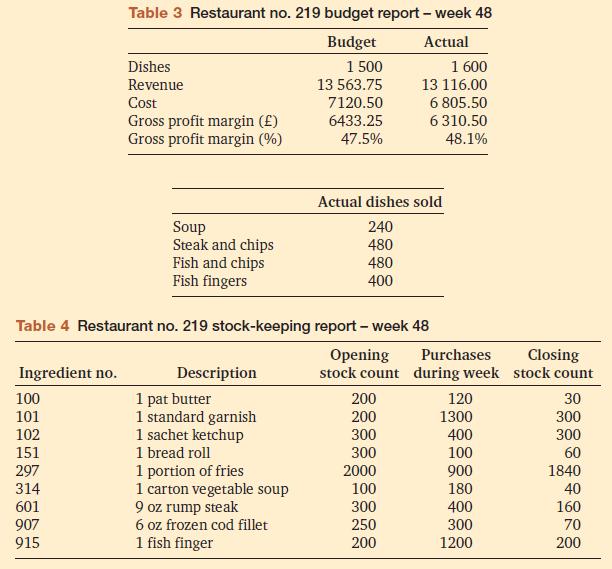

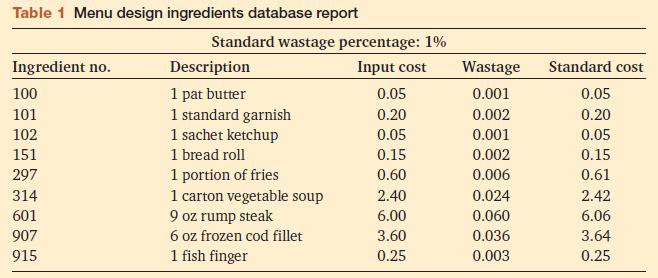

The process of developing individual restaurant budgets started with an estimation of the achievable level of sales growth based on expected number of dishes and prices from the central menu. Budgets were painstakingly built up. They drew on the database of standard ingredient costs, which included a standard allowance for wastage (Table 1). Then dish specifications, prices and expected sales mix were decided Table 2). For weekly management reporting this data was used to generate a target food margin based on each restaurant’s actual dish-mix that could be compared with the actual cost of food used (Table 3). The actual cost of food was calculated by adding the opening inventory to deliveries received minus closing inventory (see Table 4).

In order to take advantage of centralised purchasing and also to ensure tight control over quality standards, restaurants sourced all their food purchases through the centralised supply chain. Especially for seasonal produce it was normal for Hereford Steak Houses to agree price bands with their food suppliers. Fluctuations in the price of food purchased were accounted for by the central purchasing department. The weekly budget reports for the restaurants were based on the standard costs that had been defined during the design of the menu.

Questions

1. Calculate the following variances for restaurant no. 219: static budget variance, sales volume variance, sales mix variance, sales quantity variance and the flexible budget variance.

2. Calculate usage variances for all ingredients for restaurant no. 219.

3. If you were the manager of restaurant no. 219, what would you do?

4. Recently the central purchasing department managed to secure a 5 per cent reduction on the input cost for steaks and a 15 per cent reduction in the input costs of portions of fries compared with those shown in Table 1. Calculate the resulting price variances for restaurant no. 219 for week 48.

Table 1

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg