Question:

All sales for Malik and Associates are on credit. Accounts receivable at the end of last quarter totaled \($100,000\) (assume entire amount will be collected). Credit sales for the first quarter of the upcoming period are expected to be \($300,000.\) The company expects to collect 70 percent of sales in the quarter of the sale, and 30 percent the quarter following the sale. Prepare a sales cash collections budget for the first quarter of the upcoming period using the top of Exhibit 9.9 as a guide.

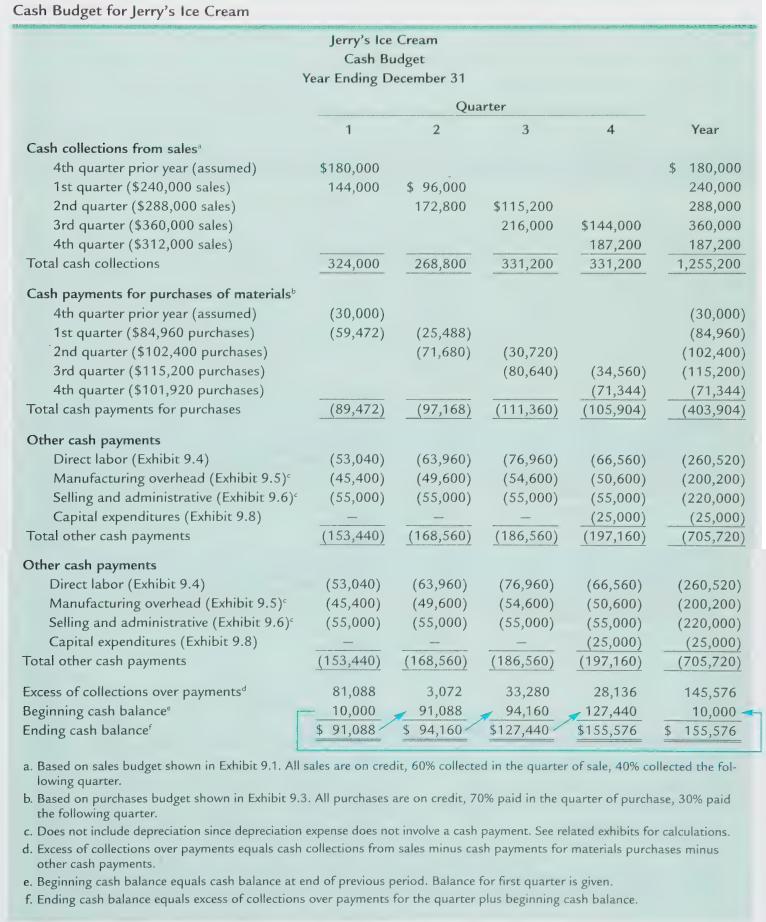

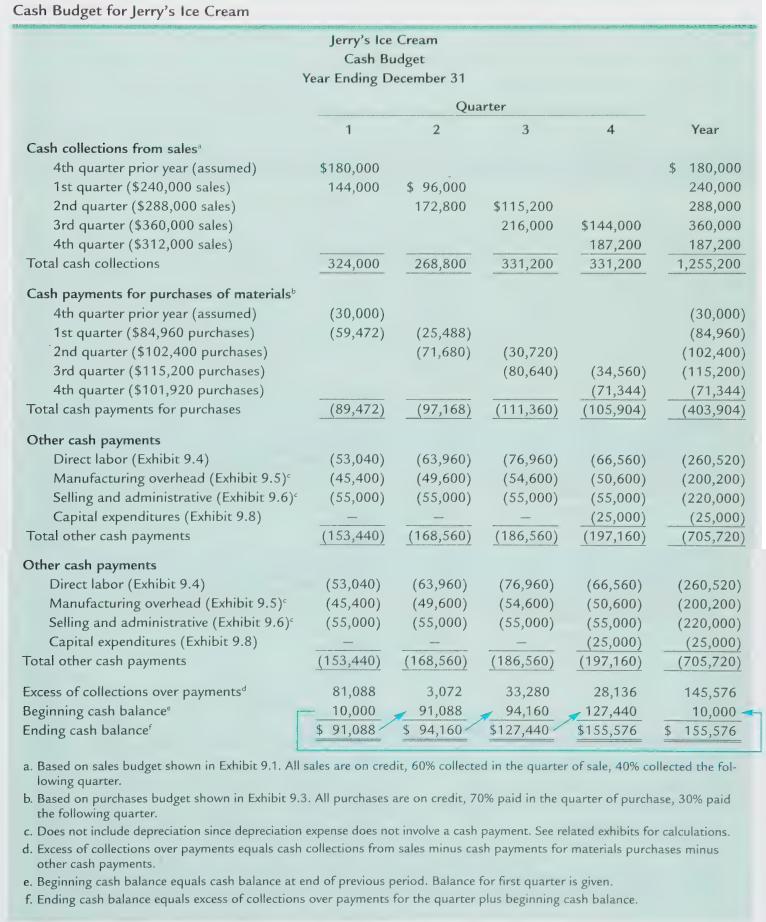

Exhibit 9.9

Transcribed Image Text:

Cash Budget for Jerry's Ice Cream Cash collections from sales Jerry's Ice Cream Cash Budget Year Ending December 31 Quarter 1 2 3 Year 4th quarter prior year (assumed) 1st quarter ($240,000 sales) $180,000 $ 180,000 144,000 $ 96,000 240,000 2nd quarter ($288,000 sales) 172,800 $115,200 288,000 3rd quarter ($360,000 sales) 216,000 $144,000 360,000 4th quarter ($312,000 sales) 187,200 187,200 Total cash collections 324,000 268,800 331,200 331,200 1,255,200 Cash payments for purchases of materials 4th quarter prior year (assumed) (30,000) (30,000) 1st quarter ($84,960 purchases) 2nd quarter ($102,400 purchases) 3rd quarter ($115,200 purchases) 4th quarter ($101,920 purchases) (59,472) (25,488) (84,960) (71,680) (30,720) (102,400) (80,640) (34,560) (115,200) (71,344) (71,344) Total cash payments for purchases (89,472) (97,168) (111,360) (105,904) (403,904) Other cash payments Direct labor (Exhibit 9.4) (53,040) (63,960) (76,960) (66,560) (260,520) Manufacturing overhead (Exhibit 9.5) (45,400) (49,600) (54,600) (50,600) (200,200) Selling and administrative (Exhibit 9.6) < (55,000) (55,000) (55,000) (55,000) (220,000) Capital expenditures (Exhibit 9.8) (25,000) (25,000) Total other cash payments (153,440) (168,560) (186,560) (197,160) (705,720) Other cash payments Direct labor (Exhibit 9.4) (53,040) (63,960) (76,960) (66,560) (260,520) Manufacturing overhead (Exhibit 9.5) (45,400) (49,600) (54,600) (50,600) (200,200) Selling and administrative (Exhibit 9.6) < (55,000) (55,000) (55,000) (55,000) (220,000) Capital expenditures (Exhibit 9.8) (25,000) (25,000) Total other cash payments (153,440) (168,560) (186,560) (197,160) (705,720) Excess of collections over payments 81,088 Beginning cash balance 10,000 Ending cash balance $ 91,088 3,072 91,088 $ 94,160 33,280 28,136 145,576 94,160 $127,440 127,440 10,000 $155,576 $ 155,576 a. Based on sales budget shown in Exhibit 9.1. All sales are on credit, 60% collected in the quarter of sale, 40% collected the fol- lowing quarter. b. Based on purchases budget shown in Exhibit 9.3. All purchases are on credit, 70% paid in the quarter of purchase, 30% paid the following quarter. c. Does not include depreciation since depreciation expense does not involve a cash payment. See related exhibits for calculations. d. Excess of collections over payments equals cash collections from sales minus cash payments for materials purchases minus other cash payments. e. Beginning cash balance equals cash balance at end of previous period. Balance for first quarter is given. f. Ending cash balance equals excess of collections over payments for the quarter plus beginning cash balance.