The production budget for Kaminski Products shows the company expects to produce 500 units in the first

Question:

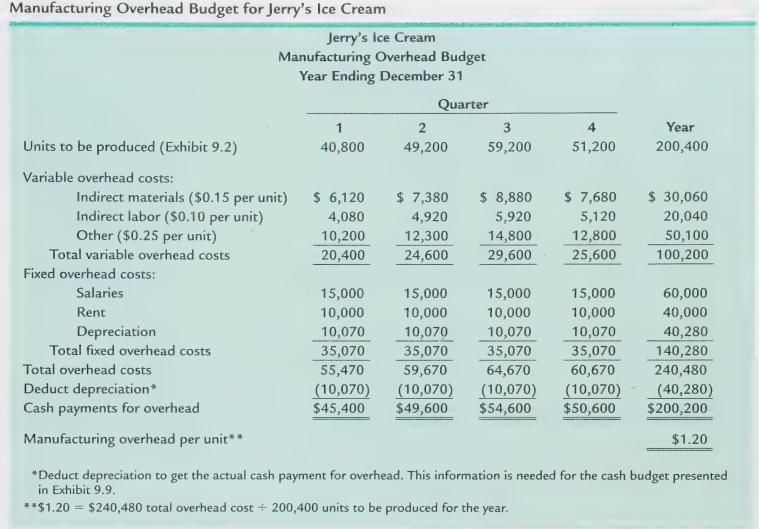

The production budget for Kaminski Products shows the company expects to produce 500 units in the first quarter. Assume variable overhead cost per unit is \($5\) for indirect materials, \($8\) for indirect labor, and \($3\) for other items. Fixed overhead cost per quarter is \($30,000\) for salaries, \($20,000\) for rent, and \($8,000\) for depreciation. Prepare a manufacturing overhead budget for the first quarter using Exhibit 9.5 as a guide.

Exhibit 9.5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: