Question

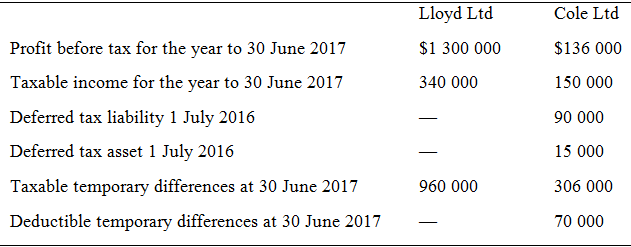

The following data applies to the two unrelated companies Lloyd Ltd and Cole Ltd: All taxable and deductible temporary differences relate to the profit or

The following data applies to the two unrelated companies Lloyd Ltd and Cole Ltd:

All taxable and deductible temporary differences relate to the profit or loss. Assume a corporate tax rate of 30%.

A. For each company, prepare the journal entries to record the current and deferred tax for 30 June 2017.

B. For each company, prepare the income tax section of the statement of profit or loss and other comprehensive income for the year ended 30 June 2017, and show the note disclosure for the current and deferred components of income tax expense.

Profit before tax for the year to 30 June 2017 Taxable income for the year to 30 June 2017 Deferred tax liability 1 July 2016 Deferred tax asset 1 July 2016 Taxable temporary differences at 30 June 2017 Deductible temporary differences at 30 June 2017 Lloyd Ltd $1 300 000 340 000 960 000 Cole Ltd $136 000 150 000 90 000 15 000 306 000 70 000

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A LLOYD LTD Taxable income 340 000 Corporate tax rate 30 Current tax liability at 30 June 2017 102 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started