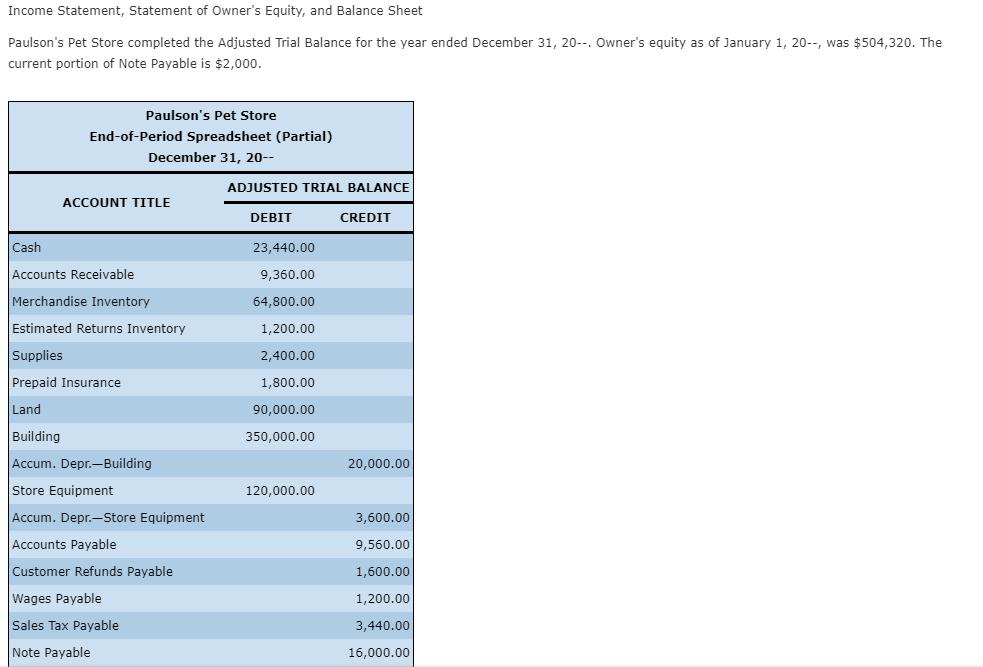

Income Statement, Statement of Owner's Equity, and Balance Sheet Paulson's Pet Store completed the Adjusted Trial Balance for the year ended December 31, 20--.

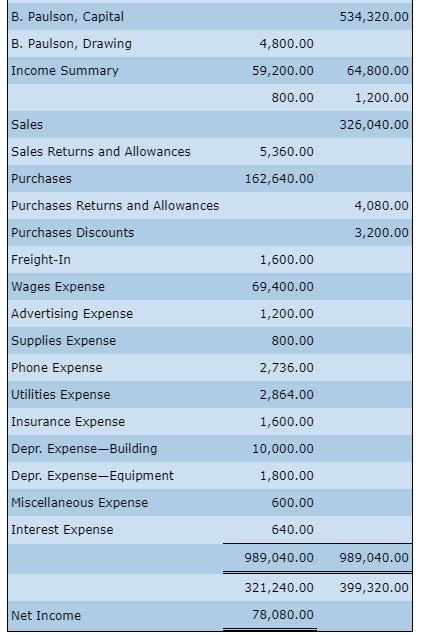

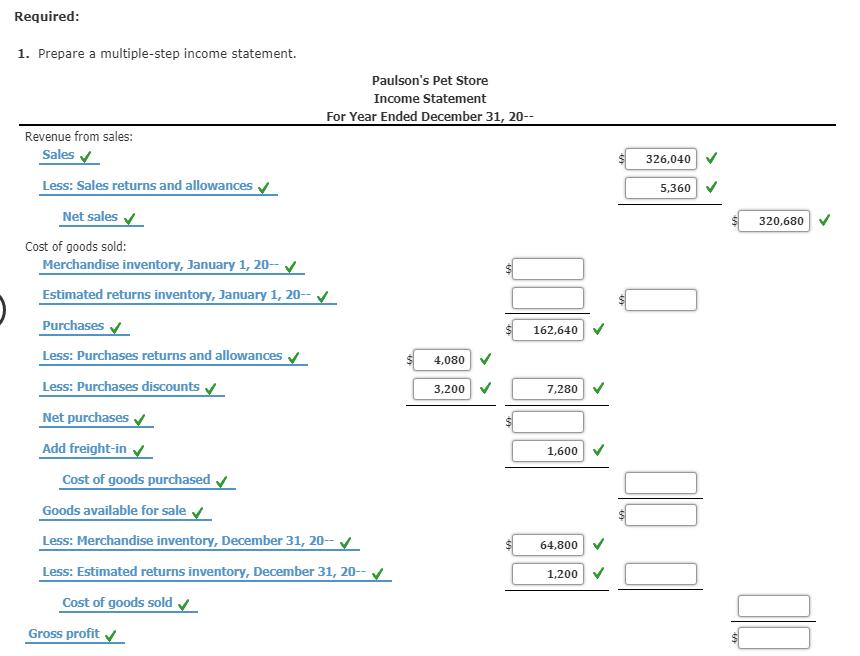

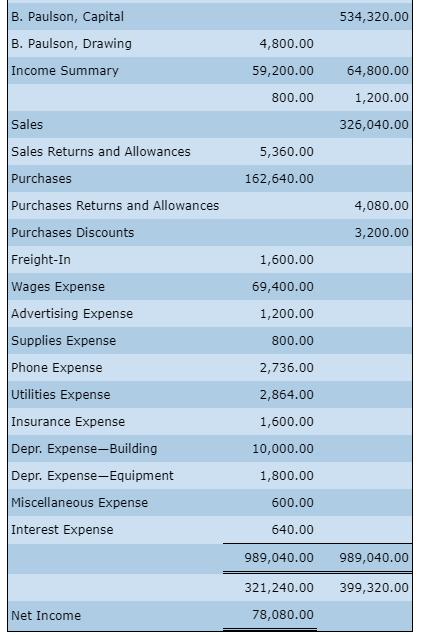

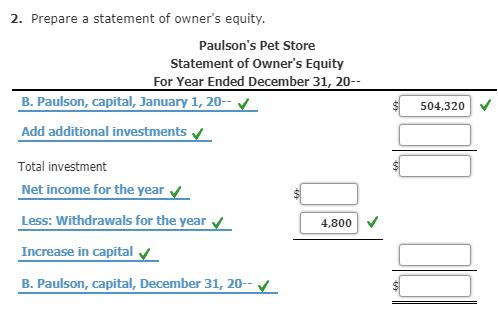

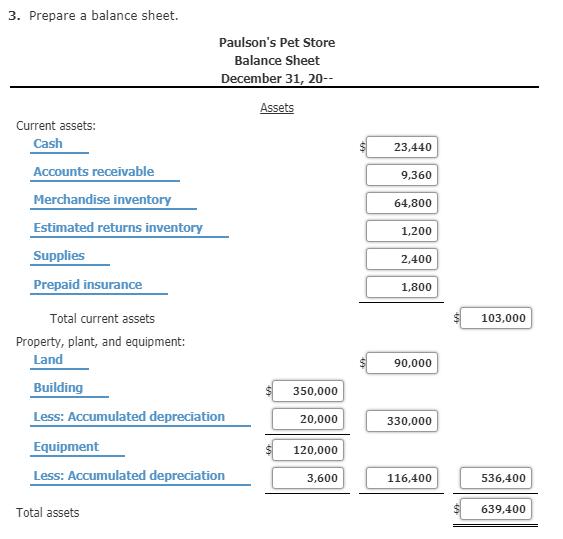

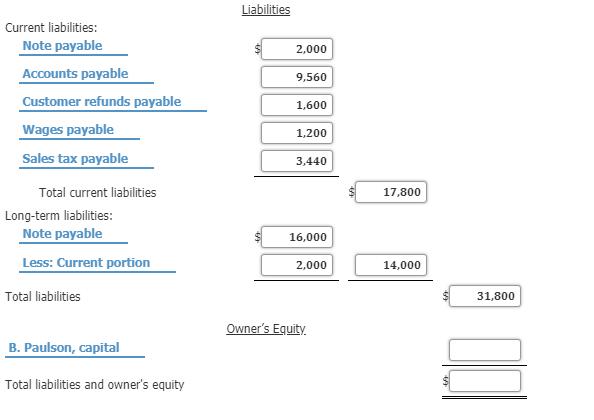

Income Statement, Statement of Owner's Equity, and Balance Sheet Paulson's Pet Store completed the Adjusted Trial Balance for the year ended December 31, 20--. Owner's equity as of January 1, 20--, was $504,320. The current portion of Note Payable is $2,000. Paulson's Pet Store End-of-Period Spreadsheet (Partial) December 31, 20-- ACCOUNT TITLE Cash Accounts Receivable Merchandise Inventory Estimated Returns Inventory Supplies Prepaid Insurance Land Building Accum. Depr.-Building Store Equipment Accum. Depr.-Store Equipment Accounts Payable Customer Refunds Payable Wages Payable Sales Tax Payable Note Payable ADJUSTED TRIAL BALANCE DEBIT 23,440.00 9,360.00 64,800.00 1,200.00 2,400.00 1,800.00 90,000.00 350,000.00 120,000.00 CREDIT 20,000.00 3,600.00 9,560.00 1,600.00 1,200.00 3,440.00 16,000.00 B. Paulson, Capital B. Paulson, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Phone Expense Utilities Expense Insurance Expense Depr. Expense-Building Depr. Expense-Equipment Miscellaneous Expense Interest Expense Net Income 4,800.00 59,200.00 800.00 5,360.00 162,640.00 1,600.00 69,400.00 1,200.00 800.00 2,736.00 2,864.00 1,600.00 10,000.00 1,800.00 600.00 640.00 534,320.00 64,800.00 1,200.00 326,040.00 4,080.00 3,200.00 989,040.00 989,040.00 321,240.00 399,320.00 78,080.00 Required: O 1. Prepare a multiple-step income statement. Revenue from sales: Sales Less: Sales returns and allowances Net sales Cost of goods sold: Merchandise inventory, January 1, 20-- Estimated returns inventory, January 1, 20-- Purchases Less: Purchases returns and allowances Less: Purchases discounts Net purchases Add freight-in Cost of goods purchased Paulson's Pet Store Income Statement For Year Ended December 31, 20-- Goods available for sale Less: Merchandise inventory, December 31, 20-- Less: Estimated returns inventory, December 31, 20-- Cost of goods sold Gross profit 4,080 3,200 162,640 7,280 1,600 64,800 1,200 326,040 5,360 320,680 00 B. Paulson, Capital B. Paulson, Drawing Income Summary Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Phone Expense Utilities Expense Insurance Expense Depr. Expense-Building Depr. Expense-Equipment Miscellaneous Expense Interest Expense Net Income 4,800.00 59,200.00 800.00 5,360.00 162,640.00 1,600.00 69,400.00 1,200.00 800.00 2,736.00 2,864.00 1,600.00 10,000.00 1,800.00 600.00 640.00 534,320.00 64,800.00 1,200.00 326,040.00 4,080.00 3,200.00 989,040.00 989,040.00 321,240.00 399,320.00 78,080.00 2. Prepare a statement of owner's equity. Paulson's Pet Store Statement of Owner's Equity For Year Ended December 31, 20-- B. Paulson, capital, January 1, 20-- Add additional investments Total investment Net income for the year Less: Withdrawals for the year Increase in capital B. Paulson, capital, December 31, 20-- 4,800 504,320 00 3. Prepare a balance sheet. Current assets: Cash Accounts receivable Merchandise inventory Estimated returns inventory Supplies Prepaid insurance Paulson's Pet Store Balance Sheet December 31, 20-- Total current assets Property, plant, and equipment: Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total assets Assets 350,000 20,000 120,000 3,600 23,440 9,360 64,800 ,200 2,400 1,800 90,000 330,000 116,400 103,000 536,400 639,400 Current liabilities: Note payable Accounts payable Customer refunds payable Wages payable Sales tax payable Total current liabilities Long-term liabilities: Note payable Less: Current portion Total liabilities B. Paulson, capital Total liabilities and owner's equity Liabilities 2,000 9,560 1,600 1,200 3,440 16,000 2,000 Owner's Equity 17,800 14,000 31,800

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Revenue from sales Sales Less Sales return and allowances ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards