Calculate NPVunequal cash flows (Learning Objective 4) Bevil Industries is deciding whether to automate one phase of

Question:

Calculate NPV—unequal cash flows (Learning Objective 4)

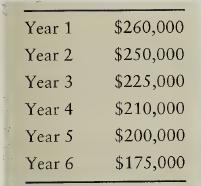

Bevil Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $900,000. Projected net cash inflows are as follows:

Requirements 1. Compute this project’s NPV using Bevil Industries’s 14% hurdle rate. Should Bevil Industries invest in the equipment? Why or why not?

2. Bevil Industries could refurbish the equipment at the end of six years for $100,000. The refurbished equipment could be used one more year, providing $75,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $50,000 residual value at the end of Year 7. Should Bevil Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.)

Step by Step Answer:

Managerial Accounting

ISBN: 9780138129712

1st Edition

Authors: Linda Smith Bamber, Karen Wilken Braun, Jr. Harrison, Walter T.