Complete Variance Analysis and Cost Flow. Sudan Machine Company operates with a standard cost accounting system and

Question:

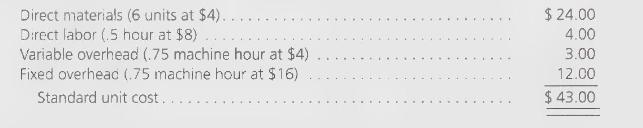

Complete Variance Analysis and Cost Flow. Sudan Machine Company operates with a standard cost accounting system and uses cost variances as a means of detecting costs that may require more control. A standard cost sheet for a component that is manufactured exclusively in one plant is as follows:

Data from the past year are as follows:

1. Purchased \(2,000,000\) units of materials at a cost of \(\$ 7,540,000\).

2. Manufactured 300,000 units of product.

3. Budgeted \(\$ 6,400,000\) for fixed overhead for the year.

4. Used \(1,812,000\) units of material in production.

5. Used 200,000 direct labor hours.

6. Spent \(\$ 1,610,000\) for direct labor.

7. Worked 190,000 actual machine hours.

8. Spent \(\$ 880,000\) for variable overhead.

9. Spent \(\$ 6,321,000\) for fixed overhead.

10. Completed 300,000 units and sold 250,000 units.

\section*{Required:}

1. Determine the following variances:

(a) Materials price variance.

(b) Materials usage variance.

(c) Labor rate variance.

(d) Labor efficiency variance

(e) Overhead budget variance.

(f) Overhead capacity variance.

2. Which is the largest unfavorable variance that may be controllable by production management? Explain.

3. If the capacity variance is unfavorable by a large amount, what steps may be taken to correct it?

Data from the past year are as follows:

1. Purchased \(2,000,000\) units of materials at a cost of \(\$ 7,540,000\).

2. Manufactured 300,000 units of product.

3. Budgeted \(\$ 6,400,000\) for fixed overhead for the year.

4. Used \(1,812,000\) units of material in production.

5. Used 200,000 direct labor hours.

6. Spent \(\$ 1,610,000\) for direct labor.

7. Worked 190,000 actual machine hours.

8. Spent \(\$ 880,000\) for variable overhead.

9. Spent \(\$ 6,321,000\) for fixed overhead.

10. Completed 300,000 units and sold 250,000 units.

\section*{Required:}

1. Determine the following variances:

(a) Materials price variance.

(b) Materials usage variance.

(c) Labor rate variance.

(d) Labor efficiency variance

(e) Overhead budget variance.

(f) Overhead capacity variance.

2. Which is the largest unfavorable variance that may be controllable by production management? Explain.

3. If the capacity variance is unfavorable by a large amount, what steps may be taken to correct it?

4. Using T-accounts, trace all costs through the accounts and close all variances to Cost of Goods Sold. Show the ending balances in the following accounts:

(a) Materials Inventory.

(b) Work in Process Inventory.

(c) Finished Goods Inventory.

(d) Cost of Goods Sold.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson