Comprehensive Operating Expense Variance Analysis. Pannex Manufacturing Company is a U. S. subsidiary of a Japanese company.

Question:

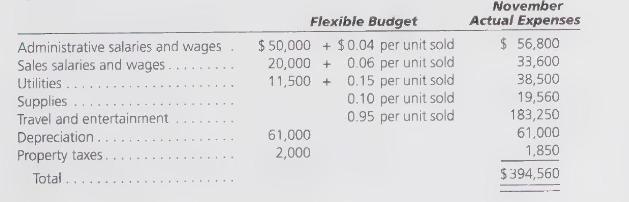

Comprehensive Operating Expense Variance Analysis. Pannex Manufacturing Company is a U. S. subsidiary of a Japanese company. It budgeted 180,000 sales units for November. The product has a budgeted selling price of \(\$ 21\) and a manufacturing cost of \(\$ 11.50\) per unit. The company's flexible expense budget for operating expenses and actual operating expenses for November are:

At the end of November, the accounting records showed that the company had sold 195,000 units for a total of \(\$ 4,000,000\) and that the cost of goods sold was \(\$ 2,240,000\).

At the end of each month, the accountant translates the budgeted and actual information into yen and sends the reports to the headquarter's office in Tokyo. The company uses the budgeted exchange rate for the year \((\$ 1=¥ 100)\) for budgeted information and the exchange rate at the end of the month \((\$ 1=¥ 105)\) for actual information.

\section*{Required:}

1. Prepare an income statement showing columns for both actual and budgeted results with spending and volume variances for each of the individual income statement items.

2. Using the translation rules given, recompute the budgeted and actual results and the spending and volume variances.

3. Is your evaluation of the variances different in the translated amounts? If yes, explain why.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson