Conversion cost per unit was} a. ($ 7.00). b. ($ 20.00). c. ($ 15.00). d. ($ 5.00).

Question:

Conversion cost per unit was}

a. \(\$ 7.00\).

b. \(\$ 20.00\).

c. \(\$ 15.00\).

d. \(\$ 5.00\).

e. \(\$ 27.60\).

Transcribed Image Text:

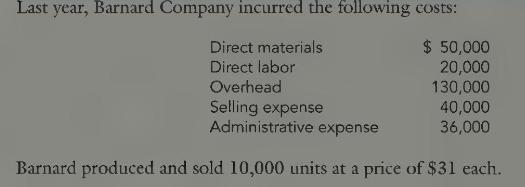

Last year, Barnard Company incurred the following costs: Direct materials Direct labor Overhead Selling expense Administrative expense $ 50,000 20,000 130,000 40,000 36,000 Barnard produced and sold 10,000 units at a price of $31 each.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Larlyu mosoti

I am a professional writer willing to do several tasks free from plagiarism, grammatical errors and submit them in time. I love to do academic writing and client satisfaction is my priority. I am skilled in writing formats APA, MLA, Chicago, and Harvard I am a statistics scientist and I can help out in analyzing your data. I am okay with SPSS, EVIEWS, MS excel, and STATA data analyzing tools.

Statistical techniques: I can do linear regression, time series analysis, logistic regression, and some basic statistical calculations like probability distributions. . I'm ready for your working projects!

Services I would offer:

• Academic writing.

• Article writing.

• Data entry.

• PDF conversion.

• Word conversion

• Proofreading.

• Rewriting.

• Data analyzing.

The best reason to hire me:

- Professional and Unique work in writing.

- 100% satisfaction Guaranteed

- within required time Express delivery

- My work is plagiarism Free

- Great communication

My passion is to write vibrantly with dedication. I am loyal and confident to give my support to every client. Because Client satisfaction is much more important to me than the payment amount. A healthy client-contractor relationship benefits in the longer term. Simply inbox me if you want clean work.

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Fundamental Cornerstones Of Managerial Accounting

ISBN: 9780333623183

1st Edition

Authors: Dan L. Heitger, Maryanne M. Mowen, Don R. Hansen

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

Jackson Corporation has borrowed $2 million from a local bank under a long-term debt agreement whereby the loan has to be repaid in two years' time. The agreement was violated and the debt became...

-

On November 1, an analyst who has been studying a firm called Computer Sciences believes that the company will make a major announcement before the end of the year. Computer Sciences currently is...

-

A portfolio of nondividend-paying stocks earned a geometric mean return of 5.0% between January 1, 2001, and December 31, 2007. The arithmetic mean return for the same period was 6.0%. If the market...

-

3. In a consolidated income statement for Pam Corporation and Subsidiary for the year 2017, consolidated cost of sales should be: a $1,372 b $1,360 c $1,272 d $1,248

-

Orasco Company uses both standards and budgets. For the year, estimated production of Product X is 500,000 units. Total estimated cost for materials and labor are $1,200,000 and $1,600,000. Compute...

-

Identify and describe the 4 Ps of The Marketing Mix, including concrete examples for each. of Starbucks

-

Cost of goods sold per unit was} a. \(\$ 7.00\). b. \(\$ 20.00\). c. \(\$ 15.00\). d. \(\$ 5.00\). e. \(\$ 27.60\). Last year, Barnard Company incurred the following costs: Direct materials Direct...

-

Prime cost per unit was a. \(\$ 7.00\). b. \(\$ 20.00\). c. \(\$ 15.00\). d. \(\$ 5.00\). e. \(\$ 27.60\). Last year, Barnard Company incurred the following costs: Direct materials Direct labor...

-

The headline of a 2023 article in the Wall Street Journal was Strong Dollar Still Rattles U.S. Multinational Corporate Earnings. a. What does the headline mean by the dollar being strong? b. What is...

-

The following information appears in the records of Poco Corporation at year-end: a. Calculate the amount of retained earnings at year-end. b. If the amount of the retained earnings at the beginning...

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B D Beginning Assets... $38,000 $22,000 $38,000 ? Liabilities.. 22,000 15,000...

-

On December 31, John Bush completed his first year as a financial planner. The following data are available from his accounting records: a. Compute John's net income for the year just ended using the...

-

Statement of Stockholders' Equity and Balance Sheet The following is balance sheet information for Flush Janitorial Service, Inc., at the end of 2019 and 2018: Required a. Prepare a balance sheet as...

-

Petty Corporation started business on January 1, 2019. The following information was compiled by Petty's accountant on December 31, 2019: Required a. You have been asked to assist the accountant for...

-

After the accounts have been adjusted at April 30, the end of the fiscal year, the following balances were taken from the ledger of Nuclear Landscaping Co.: Retained Earnings ...........$643,600...

-

Doorharmony Company makes doorbells. It has a weighted- average cost of capital of 5% and total assets of $ 5,900,000. Doorharmony has current liabilities of $ 750,000. Its operating income for the...

-

Glencove Company makes one model of radar gun used by law enforcement officers. All direct materials are added at the beginning of the manufacturing process. Information for the month of September...

-

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is...

-

The major justification for adding Step 0 to the U.S. GAAP impairment test for goodwill and indefinite lived intangibles is that it: A. Saves money spent estimating fair values B. Results in more...

Study smarter with the SolutionInn App