Eastern Incorporated is evaluating a possible ($64,000) investment in special tools that would increase cash flows from

Question:

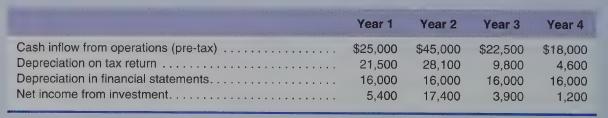

Eastern Incorporated is evaluating a possible \($64,000\) investment in special tools that would increase cash flows from operations for four years. The tools will have no salvage value. The income tax rate is 40%. Western uses a 12% hurdle rate when using present value analysis. Other information regarding the proposal is as follows:

Required

a. What are the annual net after-tax cash inflows from this proposal?

b. Compute the net present value and indicate whether it is positive or negative (round amounts to nearest dollar).

c. Compute the excess present value index.

d. Compute the cash payback period.

e. Compute the average rate of return.

f. Compute the internal rate of return.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen