EEG Ince. is a decentralized organization with four autonomous divisions. The divisions are evaluated on the basis

Question:

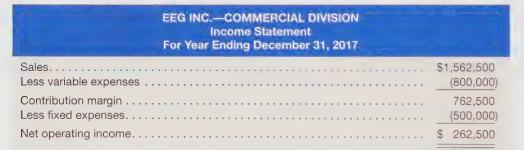

EEG Ince. is a decentralized organization with four autonomous divisions. The divisions are evaluated on the basis of the change in their return on invested assets. Operating results in the Commercial Division for 2017 follow:

Operating assets for the Commercial Division currently average \($1,500,000\). The Commercial Division can add a new product line for an investment of \($250,000\). Relevant data for the new product line are as follows:

Required

a. Determine the effect on ROI of accepting the new product line. (Round calculations to three decimal places.)

b. Ifa return of 6 percent is the minimum that any division should earn and residual income is used to evaluate managers, would this encourage the division to accept the new product line? Explain and show computations.

c. If EVA is used to evaluate managers, should the new product line be accepted if the weighted average cost of capital is 6 percent and the income tax rate is 30 percent?

Step by Step Answer: