Envision Company has a target return on capital of 12 percent. The following financial information is available

Question:

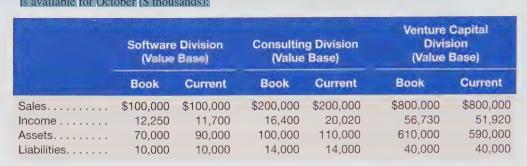

Envision Company has a target return on capital of 12 percent. The following financial information is available for October ($ thousands):

Required

a. Compute the return on investment using both book and current values for each division. (Round answers to three decimal places.)

b. Compute the residual income for both book and current values for each division.

c. Compute the economic value added income for both book and current values for each division if the tax rate is 30 percent and the weighted average cost of capital is 10 percent.

d. Does book value or current value provide a better basis for performance evaluation? Which division do you consider the most successful?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: