Equipment Replacement. Guarantee Insurance Company has been operating a cafeteria for its employees at its headquarters, but

Question:

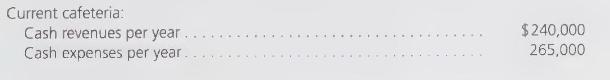

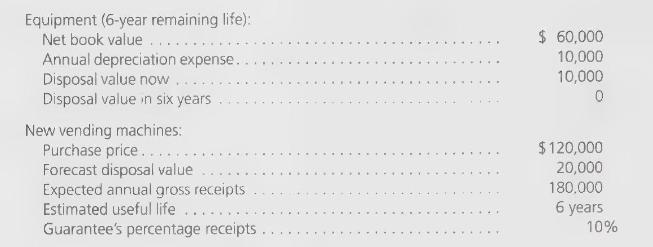

Equipment Replacement. Guarantee Insurance Company has been operating a cafeteria for its employees at its headquarters, but it is considering a conversion to a completely automated set of coin vending machines. The old equipment would be sold, and the vending machines would be purchased immediately for cash. A reputable catering firm would take complete responsibility for servicing the vending machines and would simply pay Guarantee a contracted percentage of the gross vending receipts. The following data are available:

Guarantee uses straight-line depreciation without the half-year rule and has a tax rate of 40 percent.

\section*{Required: \(\square\)}

1. Evaluate the financial aspects of the change in Guarantee's approach to the cafeteria problem by measuring:

(a) Expected change in net annual operating cash flow.

(b) Payback period.

(c) Approximate IRR.

2. Prepare a report highlighting your findings in Part (1) and any nonquantitative variables that you see impacting this decision. Comment on whether and how the nonquantitative variables can be quantified.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson