Financial modeling with multiple cost drivers. Radio, Inc., manufactures portable radios. Last year the firm sold 25,000

Question:

Financial modeling with multiple cost drivers. Radio, Inc., manufactures portable radios. Last year the firm sold 25,000 radios at $25 each. Total costs amounted to

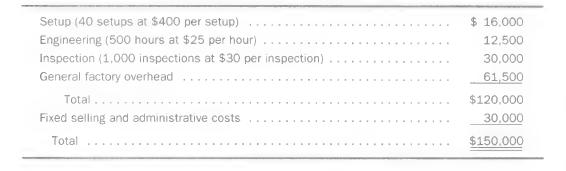

$525,000, of which $150,000 were considered fixed. An activity-based costing study recently revealed that Radio's fixed costs include the following components:

Management is considering both the installation of new, highly automated manufacturing equipment and a move toward just-in-time inventory and production management.

If t he new equipment is installed, setups will be quicker and less expensive.

Under the proposed JIT approach, there would be 300 setups per year at $50 per setup. Since a total quality program would accompany the move toward JIT, only 100 inspections are anticipated at a cost of $45 each.

After the installation of the new system, 800 hours of engineering would be required at$ 28 per hour. General factory overhead will increase to $166,100; however, the automated equipment would allow Radio, Inc. to cut its unit variable cost by 20 percent. Finally, the overall improvement in product quality would support a selling price of $26 per unit.

a. Upon seeing the analysis given in the problem, Radio's vice-president for manufacturing exclaimed to the controller, "I thought you told me this $150,000 cost was fixed. These don't look like fixed costs at all. What you're telling me now is that setup costs us $400 every time we start a production run. What gives?" As Radio's controller, write a short memo to the vice-president that clarifies the situation.

b. Compute Radio's new break-even point in units if the proposed automated equipment is i nstalled.

c. Calculate how many units Radio, Inc. will have to sell to show a profit of $140,000, assuming the new technology is adopted.

d. If Radio, Inc., adopts the new manufacturing technology, will its break-even point be higher or lower? Will the number of sales units required to earn a profit of $140,000 be higher or lower? Are the results in this case consistent with what you would typically expect to find in a modern high-tech manufacturing facility? Explain.

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson