Frances Manufacturing makes a product with total unit manufacturing cost of ($64,) of which ($36) is variable.

Question:

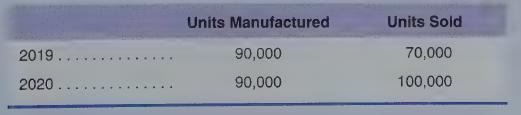

Frances Manufacturing makes a product with total unit manufacturing cost of \($64,\) of which \($36\) is variable. No units were on hand at the beginning of 2019. During 2019 and 2020, the only product manufactured was sold for \($96\) per unit, and the cost structure did not change. Frances uses the first-in, first-out inventory method and has the following production and sales for 2019 and 2020:

Required

a. Prepare gross profit computations for 2019 and 2020 using absorption costing.

b. Prepare gross profit computations for 2019 and 2020 using variable costing.

c. Explain how your answers illustrate the impact of differences between production and sales volumes on the gross profits reported each year under absorption and variable costing.

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen