Gaston Manufacturing, Inc., operates a plant that produces its own regionally marketed Spicy Steak Sauce. The sauce

Question:

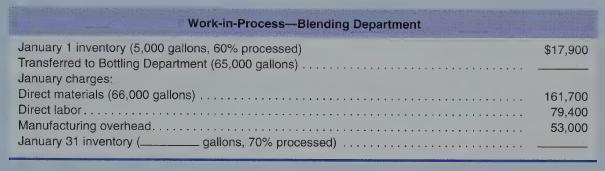

Gaston Manufacturing, Inc., operates a plant that produces its own regionally marketed Spicy Steak Sauce. The sauce is produced in two processes, blending and bottling. In the Blending Department, all materials are added at the start of the process, and labor and overhead are incurred evenly throughout the process. Gaston uses the FIFO method. The following data from the Work-in-Process-Blending Department account for January 2019 are missing a few items:

Required

Assuming Gaston uses the FIFO method in process costing, calculate the following amounts for the Blending Department:

a. Number of units in the January 31 inventory.

b. Equivalent units for materials and conversion costs.

c. January cost per equivalent unit for materials and conversion costs.

d. Cost of the units transferred to the Bottling Department.

e. Cost of the incomplete units in the January 31 inventory

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen