Question:

Hal’s Heating produces furnaces for commercial buildings. For direct materials, the standard price for a heating element part is \($40.\) A standard quantity of three heating elements is expected to be used in each furnace produced. During January, Hal’s Heating purchased 1,000 heating elements for \($38,000\) and used 980 heating elements to produce 320 furnaces.

For direct labor, Hal’s Heating established a standard number of direct labor hours at 35 hours per furnace. The standard rate is \($18\) per hour. A total of 10,000 direct labor hours were worked during January, at a cost of \($190,000,\) to produce 320 furnaces.

Required

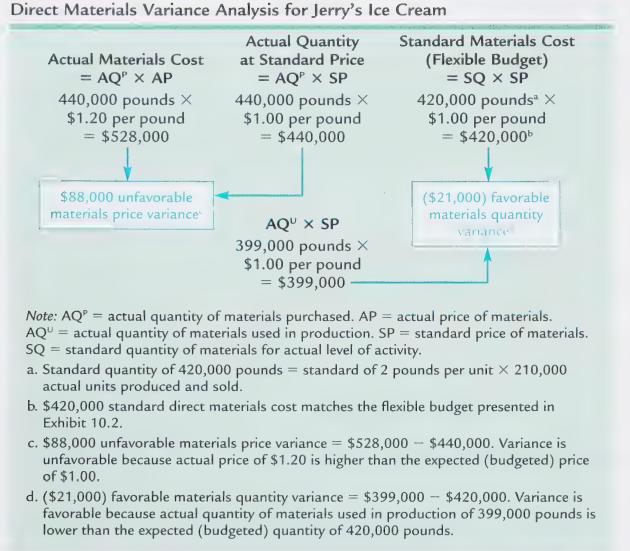

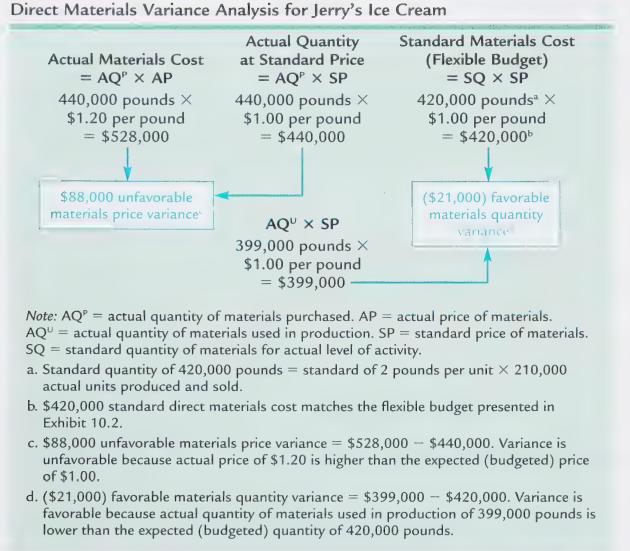

a. Calculate the materials price variance and the materials quantity variance using the format shown in Exhibit 10.3. Clearly label each of these variances as favorable or unfavorable.

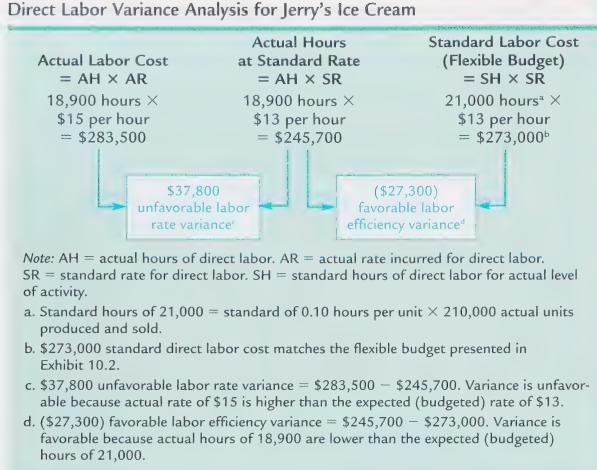

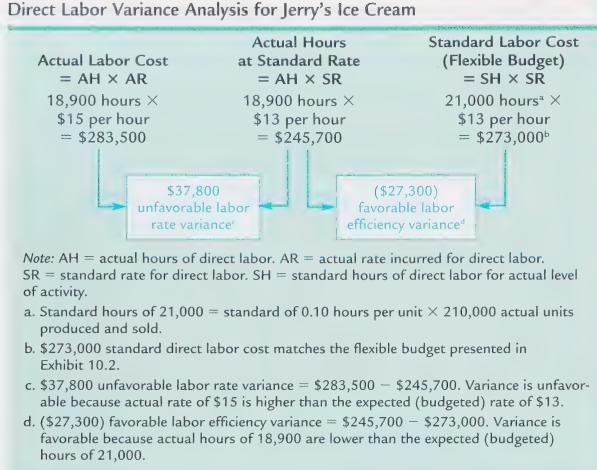

b. Calculate the labor rate variance and the labor efficiency variance using the format shown in Exhibit 10.4. Clearly label each of these variances as favorable or unfavorable.

Exhibit 10.3

Exhibit 10.4

Transcribed Image Text:

Direct Materials Variance Analysis for Jerry's Ice Cream Actual Materials Cost =AQ X AP 440,000 pounds X $1.20 per pound = $528,000 $88,000 unfavorable materials price variance Actual Quantity at Standard Price =AQP X SP 440,000 pounds X $1.00 per pound = = $440,000 AQU X SP 399,000 pounds X $1.00 per pound = $399,000 Standard Materials Cost (Flexible Budget) = SQ X SP 420,000 pounds X $1.00 per pound = $420,000b ($21,000) favorable materials quantity vanance Note: AQ= actual quantity of materials purchased. AP = actual price of materials. AQ = actual quantity of materials used in production. SP = standard price of materials. SQ = standard quantity of materials for actual level of activity. a. Standard quantity of 420,000 pounds actual units produced and sold. standard of 2 pounds per unit X 210,000 b. $420,000 standard direct materials cost matches the flexible budget presented in Exhibit 10.2. c. $88,000 unfavorable materials price variance = $528,000 - $440,000. Variance is unfavorable because actual price of $1.20 is higher than the expected (budgeted) price of $1.00. d. ($21,000) favorable materials quantity variance = $399,000 - $420,000. Variance is favorable because actual quantity of materials used in production of 399,000 pounds is lower than the expected (budgeted) quantity of 420,000 pounds.