In the past year, Oak Crafters Cabinets had total revenue of ($2,000,000,) cost of goods sold of

Question:

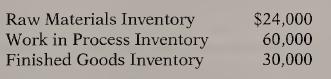

In the past year, Oak Crafters Cabinets had total revenue of \($2,000,000,\) cost of goods sold of \($800,000\) (be¬ fore adjustment for over- or underapplied overhead), administrative expenses of \($400,000,\) and selling expenses of \($200,000.\) During the year, overhead was applied using a predetermined rate of 60 percent of direct labor cost. Actual direct labor \vas \($500,000.\) Actual overhead was \($250,000.\) The ending balances in the inventory ac¬ counts (prior to adjustment for underapplied overhead) are:

Required

a. Calculate net income treating the amount of overrapplied overhead as immaterial and assigning it to Cost of Goods Sold.

b. Calculate net income treating the amount of overapplied overhead as material and apportioning it to the appropriate inventory accounts and Cost of Goods Sold. Round to the nearest whole dollar.

c. Discuss the impact of the alternative treatments.

Step by Step Answer: