Job Costing with Predetermined Overhead Rate SnoBlo Company manufactures a variety of gasoline-powered snow blowers for discount

Question:

Job Costing with Predetermined Overhead Rate SnoBlo Company manufactures a variety of gasoline-powered snow blowers for discount hardware and department stores. SnoBlo uses a job cost system and treats each customer’s order as a separate job.

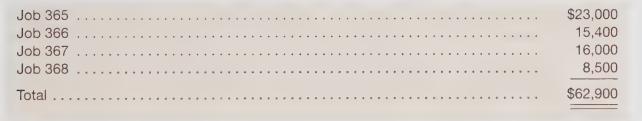

The primary snow blower components (motors, chassis, and wheels) are purchased from three different suppliers under long-term contracts that call for the direct delivery of raw materials to the production floor as needed. When a customer’s order is received, a raw materials purchase order is electronically placed with suppliers. The purchase order specifies the scheduled date that production is to begin as the delivery date for motors and chassis; the scheduled date production is to be completed is specified as the delivery date for the wheels. As a consequence, there are no raw materials inventories; raw materials are charged directly to Work-in-Process upon receipt. Upon completion, goods are shipped directly to customers rather than transferred to finished goods inventory. At the beginning of July SnoBlo had the following work-in-process inventories:

During July, the following activities took place:

¢ Started Jobs 369, 370, and 371.

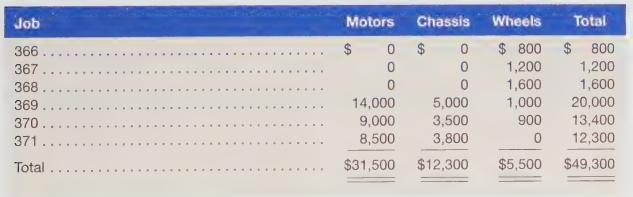

¢ Ordered and received the following raw materials for specified jobs:

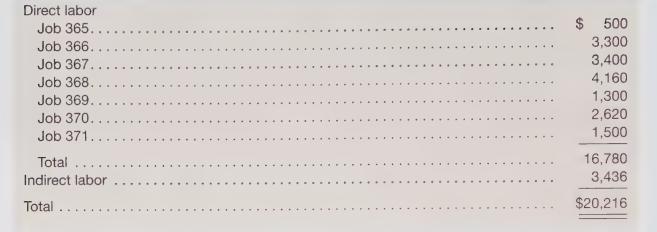

* Incurred July manufacturing payroll:

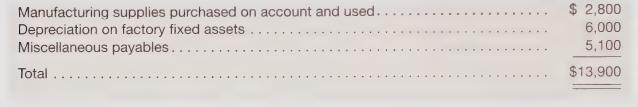

Incurred additional ma

¢ Applied manufacturing overhead using a predetermined rate based on predicted annual overhead of \($190,000\) and predicted annual direct labor of $200,000.

* Completed and shipped Jobs 365 through 370.

Required

Prepare a complete analysis of all activity in Work-in-Process. Be sure to show the beginning and ending balances, all increases and decreases, and label each item. Provide support information on decreases with job cost sheets.

Step by Step Answer: