Learning curves, managerial decisions (adapted from CMA exam). The Nippon Company purchases 80,000 pumps annually from Xing

Question:

Learning curves, managerial decisions (adapted from CMA exam). The Nippon Company purchases 80,000 pumps annually from Xing Brothers, Inc. The price has increased each year and reached $68 per unit last year. Because the purchase price has increased significantly, Nippon management has asked its analyst to estimate the cost to manufacture the pump in its own facilities. Nippon's products consist of stamping and castings. The company has little experience with products requiring assembly.

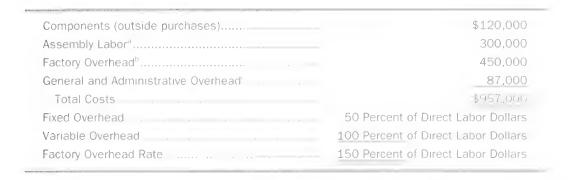

The engineering, manufacturing, and accounting departments have prepared a report for management that includes the following estimate for an assembly run of 10,000 units. The firm would hire additional production employees to manufacture the subassembly. Il would not need extra equipment, space, or supervision.

The report estimates total costs for 10,000 units at $957,000, or $95.70 a unit. The current purchase price is $68 a unit, so the report recommends continued purchase of the product.

a. Was the analysis prepared by the engineering, manufacturing, and accounting departments of N ippon Company and the recommendation to continue purchasing the pumps that followed from the analysis correct? Explain your answer and include any supportive calculations you consider necessary.

b. Assume Nippon Company could experience labor cost improvements on the pump assembly consistent with an SO percent learning curve. An assembly run of 10,000 units represents the initial lot or batch for measurement purposes. Should Nippon produce the SO. 000 pumps in this situation? Explain your answer.

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson