National Cruise Line, Inc. is considering the acquisition of a new ship that will cost ($ 180,325,005).

Question:

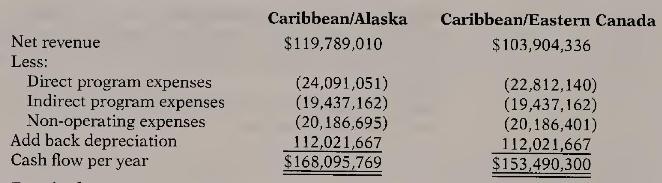

National Cruise Line, Inc. is considering the acquisition of a new ship that will cost \(\$ 180,325,005\). In this regard, the president of the company asked the CFO to analyze cash flows associated with operating the ship under two alternative itineraries: Itinerary 1, Caribbean Winter/Alaska Summer and Itinerary 2, Caribbean Winter/Eastern Canada Summer. The CFO estimated the following cash flows, which are expected to apply to each of the next 15 years:

Required

a. For each of the itineraries, calculate the present values of the cash flows using required rates of return of both 10 and 15 percent. Assume a 15 -year time horizon. Should the company purchase the ship with either or both required rates of return?

b. The president is uncertain whether a 10 percent or a 15 percent required return is appropriate. Explain why, in the present circumstance, spending a great deal of time to determine the correct required return may not be necessary.

c. Focusing on a 10 percent required rate of return, what would be the opportunity cost to the company of using the ship in a Caribbean/Eastern Canada itinerary rather than a Caribbean/Alaska itinerary?

Step by Step Answer: