Premium Products Inc. is deciding which of three approaches it should use to apply overhead to products.

Question:

Premium Products Inc. is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided below.

One plantwide rate: The predetermined overhead rate is $130 per direct labor hour.

Department rates: The Cutting Department uses a rate of 200 percent of direct labor cost, and the Finishing Department uses a rate of $50 per machine hour.

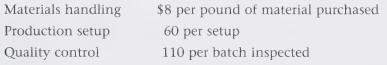

Activity-based costing rates: Three activities were identified, and rates were calculated for each activity.

Required

a. Direct labor hours totaled 2,000 for the year. Using the plantwide method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

b. During the year, the Cutting Department incurred $80,000 in direct labor costs, and the Finishing Department used 1,800 machine hours. Using the department method, calculate the amount of overhead applied to products, and make the appropriate journal entry.

c. During the year, 6,000 pounds of materials were purchased, 1,600 production setups were performed, and 1,300 batches of products were inspected. Using the activity-based costing approach, calculate the amount of overhead applied to products, and make the appropriate journal entry.

d. Premium Products Inc. closes overapplied or underapplied overhead to the Cost of Goods Sold account at the end of each year. Prepare the journal entry to close the Manufacturing Overhead account at the end of the year for each of the following independent scenarios assuming the company made the journal entry to apply overhead in requirement c.

(1) The company recorded $302,500 in actual overhead costs for the year.

(2) The company recorded $243,000 in actual overhead costs for the year.

Step by Step Answer: