Quality Chocolate Inc. would like to purchase a new machine for ($200,000.) The machine will have a

Question:

Quality Chocolate Inc. would like to purchase a new machine for \($200,000.\) The machine will have a life of four years with no salvage value, and is expected to generate annual cash revenue of \($90,000.\) Annual cash expenses, excluding depreciation, will total \($10,000.\) The company uses the straight-line depreciation method, has a tax rate of 30 percent, and requires a 14 percent rate of return.

Required

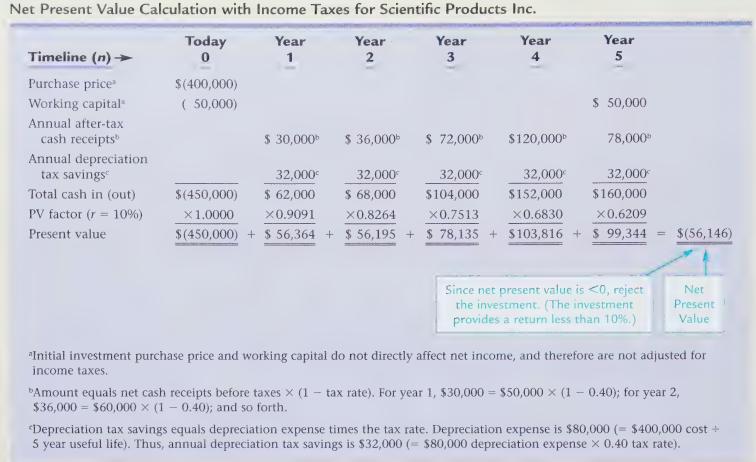

a. Find the net present value of this investment using the format presented in Table 8.7. Round to the nearest dollar.

b. Should the company purchase the machine? Explain.

Table 8.7

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: