Stainless Shine, a chain of dry-cleaning stores, has the opportunity to invest in one of two dry

Question:

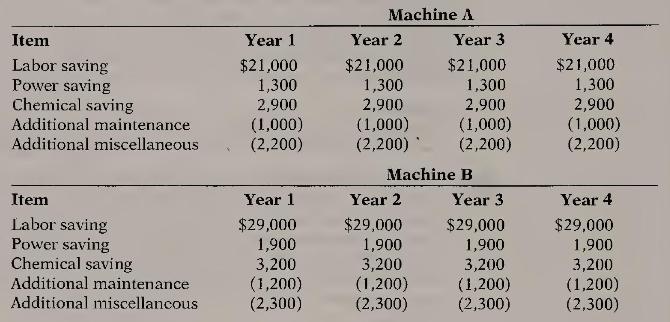

Stainless Shine, a chain of dry-cleaning stores, has the opportunity to invest in one of two dry cleaning machines. Machine A has a four-year expected life and a cost of \(\$ 43,000\). It will cost an additional \(\$ 4,500\) to have the machine delivered and installed and the expected residual value at the end of four years is \(\$ 3,200\). Machine B has a four-year expected life and a cost of \(\$ 73,000\). It will cost an additional \(\$ 5,000\) to have the machine delivered and installed and the expected residual value at the end of four years is \(\$ 5,200\). Bright Spot has a required rate of return of 14 percent. Additional cash flows related to the machines are as follows:

Required

a. Ignoring taxes, determine the net present value of investing in machine A.

b. Ignoring taxes, determine the net present value of investing in machine B.

c. Which, if any, machine should be purchased?

Step by Step Answer: