Berry Manufacturing Company purchased 90 percent of the outstanding common stock of Bussman Corporation on December 31,

Question:

Berry Manufacturing Company purchased 90 percent of the outstanding common stock of Bussman Corporation on December 31, 20X5, for \(\$ 1,150,000\). On that date, Bussman reported common stock of \(\$ 500,000\), premium on common stock of \(\$ 280,000\), and retained earnings of \(\$ 420,000\). The fair values of all of Bussman's assets and liabilities were equal to their book values on the date of combination, except for land, which was worth more than its book value. Berry estimated that its 90 percent share of the increase in the value of Bussman's land was \(\$ 30,000\)

On April 1, 20X6, Berry issued at par \(\$ 200,000\) of 10 percent bonds directly to Bussman: interest on the bonds is payable March 31 and September 30. On January 2. 20X7, Berry purchased all of Bussman's outstanding 10 -year, 12 percent bonds from an unrelated institutional investor at 98 . The bonds originally had been issued on January 2, 20X1, for 101. Interest on the bonds is payable December 31 and June 30.

Since the date it was acquired by Berry Manufacturing, Bussman has sold inventory to Berry on a regular basis. The amount of such intercompany sales totaled \(\$ 64,000\) in \(20 \times 6\) and \(\$ 78,000\) in 20X7, including a 30 percent gross profit. All the inventory transferred in 20X6 had been resold by December 31, 20X6, except inventory for which Berry paid \(\$ 15,000\) and which was not resold until January 20X7. All the inventory transferred in 20X7 had been resold at December 31, 20X7, except merchandise for which Berry had paid \(\$ 18,000\).

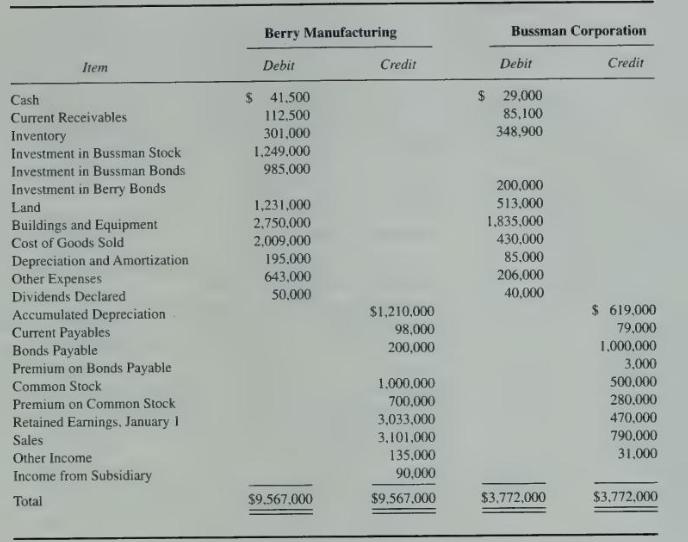

At December 31, 20X7, trial balances for Berry Manufacturing and Bussman Corporation appeared as follows:

As of December 31,20X7, Bussman had declared but not yet paid its fourth-quarter dividend of \(\$ 10,000\). Both Berry Manufacturing and Bussman use straight-line depreciation and amortization, including the amortization of bond discount and premium. On December 31, 20X7, the management of Berry Manufacturing reviewed the amount attributed to goodwill as a result of its purchase of Bussman Corporation common stock and concluded an impairment loss in the amount of \(\$ 25,000\) occurred during \(20 \times 7\). Berry Manufacturing uses the basic equity method to account for its investment in Bussman Corporation.

\section*{Required}

a. Compute the amount of the differential as of January 1,20X7.

b. Compute the balance of Berry Manufacturing's Investment in Bussman Stock account as of January \(1,20 \times 7\).

c. Compute the gain or loss on the constructive retirement of Bussman's bonds that should appear in the \(20 \times 7\) consolidated income statement.

d. Compute the income that should be assigned to the noncontrolling interest in the \(20 \times 7\) consolidated income statement.

e. Compute the total noncontrolling interest as of December 31,20X6.

f. Present all elimination entries that would appear in a three-part consolidation workpaper as of December 31, 20X7.

g. Prepare and complete a three-part workpaper for the preparation of consolidated financial statements for \(20 \times 7\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King