The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6

Question:

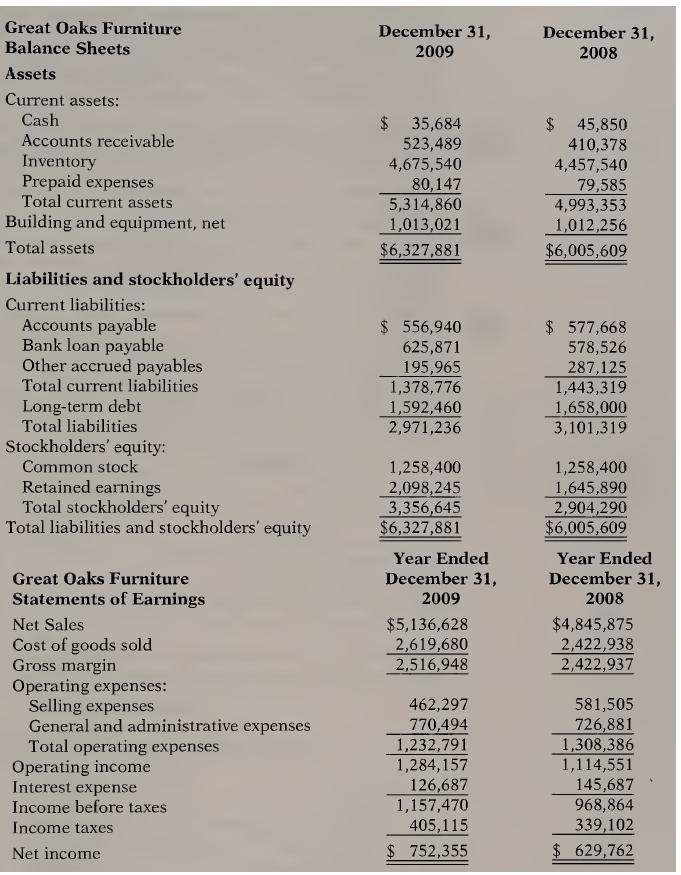

The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6 through 11.

Perform a horizontal analysis of the balance sheets and income statements for Great Oaks Furniture. Highlight changes that are greater than 10 percent. Discuss some of the causes that could lead to these changes.

Transcribed Image Text:

Great Oaks Furniture Balance Sheets Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Building and equipment, net Total assets Liabilities and stockholders' equity Current liabilities: Accounts payable Bank loan payable Other accrued payables Total current liabilities Long-term debt Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Great Oaks Furniture Statements of Earnings Net Sales December 31, 2009 December 31, 2008 $ 35,684 523,489 $ 45,850 410,378 4,457,540 4,675,540 80,147 79,585 5,314,860 4,993,353 1,013,021 $6,327,881 1,012,256 $6,005,609 $ 577,668 578,526 287,125 $ 556,940 625,871 195,965 1,378,776 1,443,319 1,592,460 1,658,000 2,971,236 3,101,319 1,258,400 1,258,400 2,098,245 1,645,890 3,356,645 2,904,290 $6,327,881 Year Ended December 31, 2009 $6,005,609 Year Ended December 31, 2008 $4,845,875 $5,136,628 Cost of goods sold 2,619,680 2,422,938 Gross margin 2,516,948 2,422,937 Operating expenses: Selling expenses 462,297 581,505 General and administrative expenses 770,494 726,881 Total operating expenses 1,232,791 1,308,386 Operating income 1,284,157 1,114,551 Interest expense 126,687 145,687 Income before taxes 1,157,470 968,864 Income taxes Net income 405,115 $ 752,355 $ 629,762 339,102

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

Answered By

RADHIKA MEENAKAR

I am a qualified indian Company Secretary along with Masters in finance with over 6 plus years of professional experience. Apart from this i am a certified accounts and finance tutor on many online platforms.

My Linkedin profile link is here https://www.linkedin.com/in/radhika-meenakar-88b9808a/

5.00+

12+ Reviews

22+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Perform a horizontal analysis of the balance sheets and income statements for Great Oaks Furniture. Highlight changes that are greater than 10 percent. Discuss some of the causes that could lead to...

-

The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6 through 11. Perform a horizontal analysis of the balance sheets and income statements...

-

The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6 through 11. Perform a vertical analysis of the balance sheets and income statements for...

-

An important U.S. government organization charged with setting human resource management guidelines is O the EEOC (Equal Employment Opportunity Commission). the OSHA (Occupational Safety and Health...

-

Errors that are created during the early phase of a project, during requirements discovery, are much more expensive to fix the later in the project they are found. Explain why this is and its...

-

Consider the following balanced equation in which gas X forms gas X2: 2X(g) X2(g) Equal moles of X are placed in two separate containers. One container is rigid, so the volume cannot change; the...

-

Demand for emergency room services. With the advent of managed care, US hospitals have begun to operate like businesses. More than ever before, hospital administrators need to know and apply the...

-

Cost-Cutting Proposals Chatman Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $530,000 is estimated to result in $205,000 in...

-

Under a partnership agreement, Sarah is to receive 25 percent of the partnerships income, but not less than $12,000. The partnerships net income for this year was $32,000. What amount can the...

-

The following information for Great Oaks Furniture, a retail furniture and design firm, relates to Exercises 6 through 11. Calculate earnings per share, the price-eam-m'ssmjngs ratio, the gross...

-

Go to the Web site of Yahoo! Finance (http://finance.yahoo.com). Enter the ticker symbol for Home Depot (HD) and Lowes (LOW). For each firm, click on Profile and note the ratio for Profit Margin (the...

-

A large company has a corporation tax liability of 720,000 for an accounting period. State the dates on which instalments are payable and compute the amount of each instalment if the accounting...

-

Turn this information into an excel sheets with the excel formulas being shown P12.2 (LO 1, 2) (Liability Entries and Adjustments) Listed below are selected transactions of Schultz Department Store...

-

1. Consider an undirected random graph on the set of four vertices {A, B, C, D} such that each of the 4 2 = 6 potential edges exists with probability 0.2, independently of the presence/absence of any...

-

Basic Net Present Value Analysis Jonathan Butler, process engineer, knows that the acceptance of a new process design will depend on its economic feasibility. The new process is designed to improve...

-

Determine the support reactions at the smooth collar A and the normal reaction at the roller support B. 800 N 600 N B 0.8 m 0.4 m 0.4 m 0.8 m

-

A plant hopes to cool a steam line by sending it through a throttling valve to expand it to atmospheric pressure. The steam enters the valve at 550C and 250 bar. The expansion in the valve happens so...

-

DVDS manufactures and sells DVD players in two countries. It manufactures two models Basic and Custom in the same plant. The Basic DVD has fewer options and provides lower- quality out-put than the...

-

Consider the circuit of Fig. 7.97. Find v0 (t) if i(0) = 2 A and v(t) = 0. 1 3 ett)

-

Javier is currently paying $1,200 in interest on his credit cards annually. If, instead of paying interest, he saved this amount every year, how much would he accumulate in a tax-deferred account...

-

Your company is considering the purchase of a fleet of cars for $195,000. It can borrow at 6%. The cars will be used for four years. At the end of four years they will be worthless. You call a...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

Study smarter with the SolutionInn App