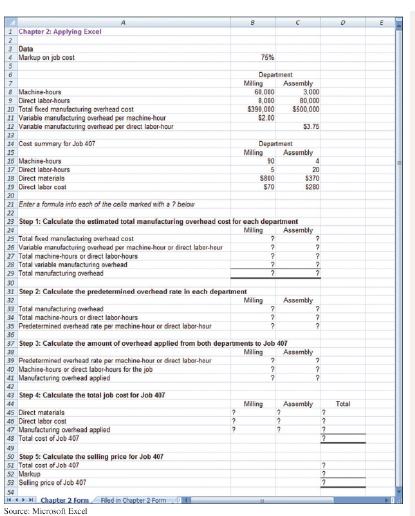

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 25. The workbook,

Question:

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2–5. The workbook, and instructions on how to complete the file, can be found in Connect.

You should proceed to the requirements below only after completing your worksheet.

Required:

1. Check your worksheet by changing the total fixed manufacturing overhead cost for the Milling Department in the Data area to $300,000 keeping all of the other data the same as in the original example. If your worksheet is operating properly, the total cost of Job 407 should now be $2,350. If you do not get this answer, find the errors in your worksheet and correct them.

How much is the selling price of Job 407? Did it change? Why or why not?

2. Change the total fixed manufacturing overhead cost for the Milling Department in the Data area back to $390,000, keeping all of the other data the same as in the original example. Determine the selling price for a new job, Job 408, with the following characteristics. You need not bother changing the job number from 407 to 408 in the worksheet.

Department Cost summary for Job 408 Milling Assembly Machine-hours... 40 10 Direct labor-hours. 2 6 Direct materials.. $700 $360 Direct labor cost.. $50 $150 3. What happens to the selling price for Job 408 if the total number of machine-hours in the Assembly Department increases from 3,000 machine-hours to 6,000 machine-hours? Does it increase, decrease, or stay the same as in part 2 above? Why?

4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-ours. What happens to the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000 direct labor-hours?

Does it increase, decrease, or stay the same as in part 2 above? Why?

Step by Step Answer:

Introduction To Managerial Accounting

ISBN: 9781265672003

9th International Edition

Authors: Peter C. Brewer , Ray H. Garrison, Eric Noreen