Transfer Pricing Problem. Leisure Company has a producing division (Division 1) which supplies several parts to another

Question:

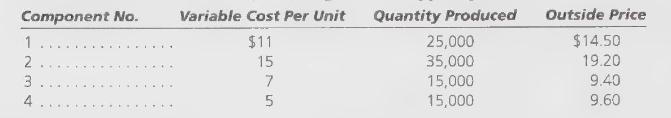

Transfer Pricing Problem. Leisure Company has a producing division (Division 1) which supplies several parts to another producing division (Division 2) which produces the main product. These component parts are listed as follows with relevant cost information, including outside supplier prices:

The out-of-pocket fixed costs of Division 1 amount to \(\$ 270,000\). These costs consist of salaries and other overhead. In addition, other fixed costs (consisting mainly of depreciation on machinery) amount to \(\$ 90,000\) per period. In calculating unit cost, total fixed costs of \(\$ 360,000\) are allocated based on units produced to arrive at a full cost.

A full-cost transfer price is used. In Division 2, which uses the four components, the manager has authority to buy inside the company or from an outside supplier. The outside prices vary somewhat throughout the year.

After calculating the full cost, the manager of Division 2 notices that outside purchase prices of Components 1 and 3 are lower than the transfer prices and places orders with outside suppliers. Division 1 stops producing these two components, reallocates fixed costs to the remaining units, and adjusts the full-cost transfer prices.

\section*{Required:}

1. Reallocate fixed costs and determine the adjusted transfer prices based on full costs of the remaining products. If no communication between the two divisions occurs, what action will the manager of Division 2 likely take?

2. Comment on the deficiencies of the full-cost transfer price system.

3. What if the items transferred to Division 2 from Division 1 are 100 percent of Division 1's business? Devise a method of assigning the fixed cost of Division 1 to Division 2 that will not cause Division 2 to buy outside when the components could be produced by Division 1.

4. What if the items transferred to Division 2 from Division 1 are 4 percent of Division 1's total business? How would your answer to Part (3) change?

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson