You are consulted by Investors, Inc., a group of investors planning a new product. They have estimates

Question:

You are consulted by Investors, Inc., a group of investors planning a new product. They have estimates of the costs of materials, labor, overhead, and other expenses for 2019 but need to know how much to charge for each unit to earn a profit in 2019 equal to 10% of their estimated investment of \($500,000\) (ignore income taxes).

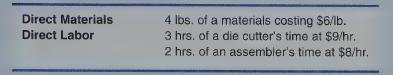

Their plans indicate that each unit of the new product requires the following:

Major items of production overhead would be annual rent of \($40,000\) on the factory building and \($25,000\) on machinery as well as indirect materials of \($21,000\). Other production overhead is an estimated 60% of total direct labor costs. Selling expenses are an estimated 20% of total sales, and nonfactory administrative expenses are 10% of total sales.

The consensus at Investors is that during 2019, 4,000 units of product should be produced for selling and another 1,000 units should be produced for the next year’s beginning inventory. Also, an extra 6,000 pounds of materials will be purchased as beginning inventory for the next year. Because of the nature of the manufacturing process, all units started must be completed, so work-in-process inventories are negligible.

Required

a. Incorporate the above data into a schedule of estimated total manufacturing costs and compute the unit production cost for 2019.

Prepare an estimated income statement that would provide the target amount of profit for 2019.

c. What unit sales price should Investors charge for the new product?

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen