Question: Why is leasing listed in Table 12.9 as a means of generating cash? Table 12.9 Ways of Getting Cash for Expansion Operating Save income from

Why is leasing listed in Table 12.9 as a means of generating cash?

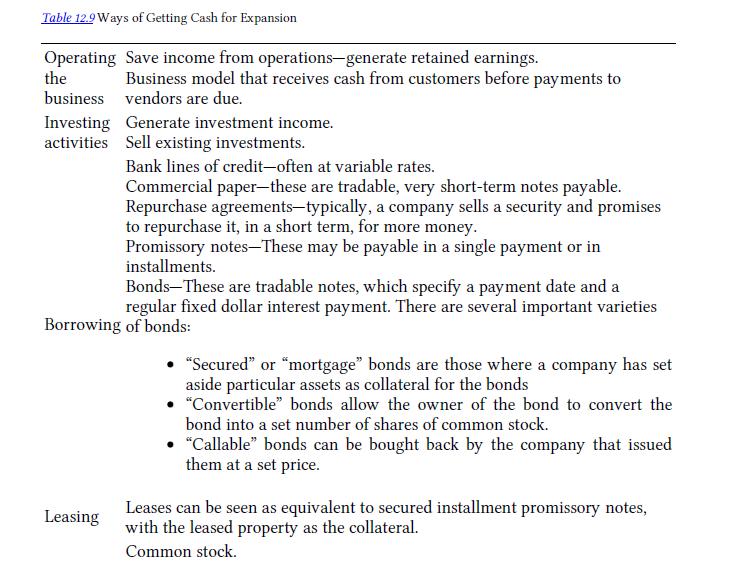

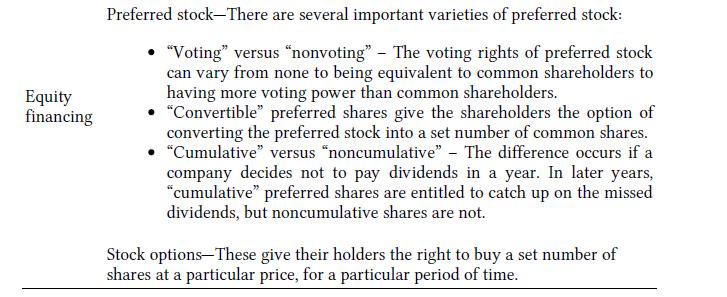

Table 12.9 Ways of Getting Cash for Expansion Operating Save income from operations-generate retained earnings. the Business model that receives cash from customers before payments to business vendors are due. Investing Generate investment income. activities Sell existing investments. Bank lines of credit-often at variable rates. Commercial paper-these are tradable, very short-term notes payable. Repurchase agreements-typically, a company sells a security and promises to repurchase it, in a short term, for more money. Promissory notes-These may be payable in a single payment or in installments. Bonds-These are tradable notes, which specify a payment date and a regular fixed dollar interest payment. There are several important varieties Borrowing of bonds: Leasing "Secured" or "mortgage" bonds are those where a company has set aside particular assets as collateral for the bonds "Convertible" bonds allow the owner of the bond to convert the bond into a set number of shares of common stock. "Callable" bonds can be bought back by the company that issued them at a set price. Leases can be seen as equivalent to secured installment promissory notes, with the leased property as the collateral. Common stock.

Step by Step Solution

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts