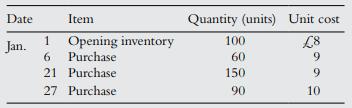

Suppose a division of a computer manufacturing company has these inventory records for January 20x6 Company accounting

Question:

Suppose a division of a computer manufacturing company has these inventory records for January 20x6

Company accounting records reveal that operating expenses for January were £2,900, and sales of 310 units have generated sales revenue of £9,000.

Requie:

1. Prepare the January SPL, showing amounts for FIFO, LIFO, and WAC. Label the bottom line “Operating income”.

2. Suppose you are the financial accountant of that company.

Which inventory valuation method will you use if your motive is to:

a. Minimise income taxes?

b. Report the highest operating income?

c. Report operating income between the extremes of FIFO and LIFO?

d. Report inventory on the SFP at the most current cost?

e. Achieve the best measure of net income for the SPL?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: