James Jones received a $90,000 cash advance on March 1, Year 1, for legal services to be

Question:

James Jones received a $90,000 cash advance on March 1, Year 1, for legal services to be performed in the future. Services were to be provided for a one-year term beginning March 1, Year 1.

Required

a. Record the March 1 cash receipt in T-accounts.

b. Record in T-accounts the adjustment required as of December 31, Year 1.

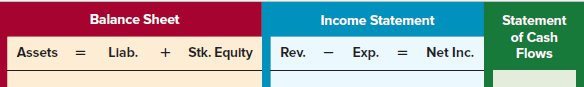

c. Show the preceding transaction and related adjustment in a horizontal statements model like the following one:

d. Determine the amount of net income on the Year 1 income statement. What is the amount of net cash flow from operating activities for Year 1?

e. What amount of unearned revenue would Jones report on the December 31, Year 1, balance sheet?

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds