Margaret Company is a wholesaler that uses the perpetual inventory system. On January 1, 2018, Margaret had

Question:

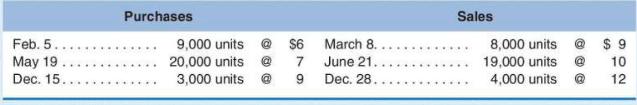

Margaret Company is a wholesaler that uses the perpetual inventory system. On January 1, 2018, Margaret had 3,000 units of its product at a cost of \(\$ 5\) per unit. Transactions related to inventory during 2018 were as follows:

Margaret is trying to decide whether to use the first-in, first-out (FIFO) inventory costing method or the last-in, first-out (LIFO) inventory costing method.

Required

a. Assume that Margaret decides to use the FIFO inventory costing method.

1. What would gross profit be for 2018 ?

2. How would Margaret's gross profit and ending inventory for 2018 change if the December 15,2018 , purchase had been made on January 3, 2019, instead?

3. How would Margaret's gross profit and ending inventory for 2018 change if the December 15,2018 , purchase had been for 6,000 units instead of 3,000 units?

b. Assume that Margaret decides to use the LIFO inventory costing method.

1. What would gross profit be for 2018 ?

2. How would Margaret's gross profit and ending inventory for 2018 change if the December 15,2018 , purchase had been made on January 3, 2019, instead?

3. How would Margaret's gross profit and ending inventory for 2018 change if the December 15,2018 , purchase had been for 6,000 units instead of 3,000 units?

c. Which inventory costing method should Margaret choose and why?

Step by Step Answer: