Refer to the data given for the Sky Company in Problem P12-4A. Required a. Calculate the change

Question:

Refer to the data given for the Sky Company in Problem P12-4A.

Required

a. Calculate the change in cash that occurred in 2019.

b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid for wages and other operating expenses." Accounts payable relate to inventory purchases only.

Problem P12-4A.

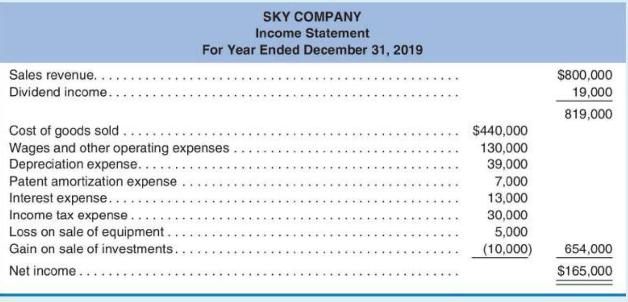

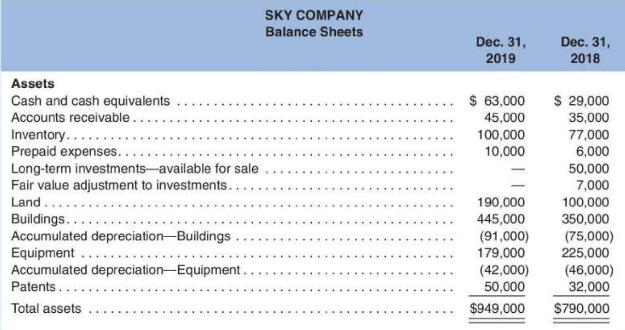

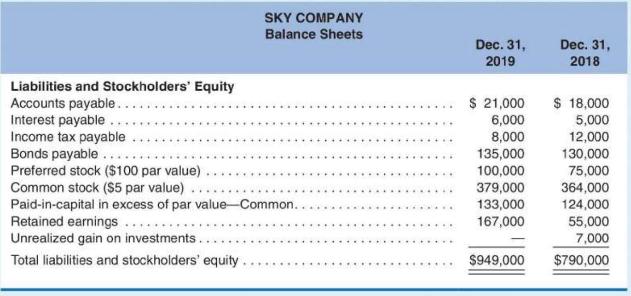

The Sky Company's income statement and comparative balance sheets as of December 31 of 2019 and 2018 follow:

During the year, the following transactions occurred:

1. Sold long-term investments costing \(\$ 50,000\) for \(\$ 60,000\) cash. Unrealized gains totaling \(\$ 7,000\) related to these investments had been recorded in earlier years. At year-end, the fair value adjustment and unrealized gain account balances were eliminated.

2. Purchased land for cash.

3. Capitalized an expenditure made to improve the building.

4. Sold equipment for \(\$ 14,000\) cash that originally cost \(\$ 46,000\) and had \(\$ 27,000\) accumulated depreciation.

5. Issued bonds payable at face value for cash.

6. Acquired a patent with a fair value of \(\$ 25,000\) by issuing 250 shares of preferred stock at par value.

7. Declared and paid a \(\$ 53,000\) cash dividend.

8. Issued 3,000 shares of common stock for cash at \(\$ 8\) per share.

9. Recorded depreciation of \(\$ 16,000\) on buildings and \(\$ 23,000\) on equipment.

Step by Step Answer: