The bank reconciliation made by Thurman, Inc., on August 31 showed a deposit in transit of ($

Question:

The bank reconciliation made by Thurman, Inc., on August 31 showed a deposit in transit of \(\$ 1,170\) and two outstanding checks, No. 597 for \(\$ 650\) and No. 603 for \(\$ 710\). The reconciled cash balance on August 31 was \(\$ 14,110\).

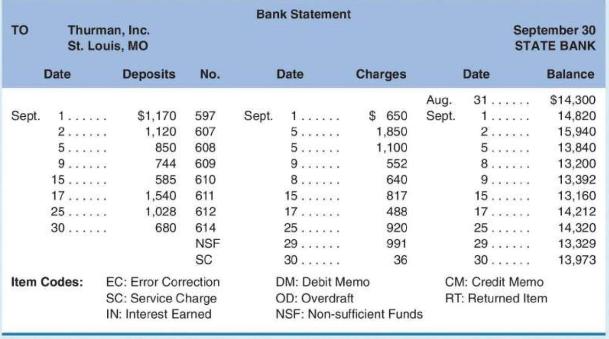

The following bank statement is available for September:

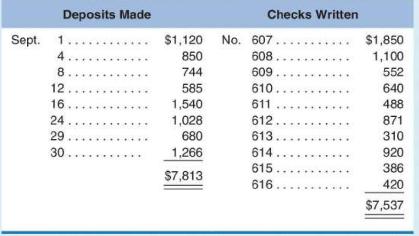

A list of deposits made and checks written during September is shown below:

The Cash in Bank account balance on September 30 was \(\$ 14,386\). In reviewing checks returned by the bank, the accountant discovered that check No. 612 , written for \(\$ 817\) for advertising expense, was recorded in the cash disbursements journal as \(\$ 871\). The NSF check for \(\$ 991\), which Thurman deposited on September 24, was a payment on account from customer D. Walker.

Required

a. Prepare a bank reconciliation for Thurman, Inc., at September 30.

b. Prepare the necessary journal entries to bring the Cash in Bank account into agreement with the reconciled cash balance on the bank reconciliation.

Step by Step Answer: