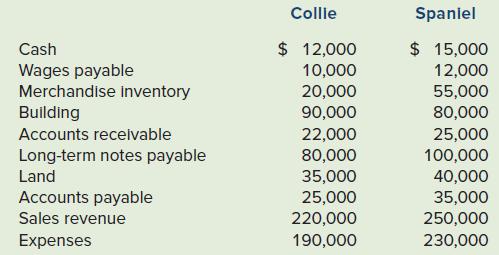

The following accounting information exists for Collie and Spaniel companies: Required a. Identify the current assets and

Question:

The following accounting information exists for Collie and Spaniel companies:

Required

a. Identify the current assets and current liabilities and compute the current ratio for each company.

b. Assuming that all assets and liabilities are listed here, compute the debt-to-assets ratios for each company.

c. Determine which company has the greater financial risk in both the short term and the long term.

Collie Spanlel Cash $ 12,000 $ 15,000 Wages payable Merchandise Inventory Building 10,000 20,000 90,000 12,000 55,000 80,000 Accounts receivable 22,000 80,000 35,000 25,000 220,000 25,000 100,000 40,000 35,000 250,000 230,000 Long-term notes payable Land Accounts payable Sales revenue Expenses 190,000

Step by Step Answer:

A For Company Collie Total Current Assets CashMerchandise InventoryAccounts Receivable 1200020000220...View the full answer

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Related Video

The accounting equation is a formula that shows the sum of a company\\\'s liabilities and shareholders\\\' equity are equal to its total assets (Assets = Liabilities + Equity). The clear-cut relationship between a company\\\'s liabilities, assets, and equity is the backbone of double-entry bookkeeping.

Students also viewed these Business questions

-

The following accounting information exists for Collie and Spaniel companies at the end of 2016: Required a. Identify the current assets and current liabilities and compute the current ratio for each...

-

The following accounting information exists for the Aspen and Willow companies: Required a. Identify the current assets and current liabilities and compute the current ratio for each company. b....

-

The following accounting information exists for Poe and Scott companies at the end of 2014: Required a. Identify the current assets and current liabilities and compute the current ratio for each...

-

Brennan Physiotherapies had a beta of 0.85. Reasonable estimates for the RF and the required rate of return on the market, R(Rm) were 7% and 15%, respectively. What is the required rate of return on...

-

Two gel pens, Gel-1 and Gel-2, are compared on the basis of the number of weeks before they stop writing. Out of 27 persons available, 13 are randomly chosen to receive Gel-1 and the other 14 receive...

-

Accounting Theory: Substance of Over- and Underallocating Taxes Assume that Poxco and Soxco, Poxcos 100%-owned subsidiary, file a consolidated income tax return. Poxco allocates in come tax expense...

-

Explain how we can use the pseudo-F statistic to select the optimal number of clusters.

-

Members of the board of directors of Locktight Systems have received the following operating income data for the year just ended: Members of the board are surprised that the industrial systems...

-

Use the appropriate information from the data provided below to calculate operating income for the year ended December 31, 2018. Cost of goods sold $234,000 General and administrative expenses 96,000...

-

Table 1 shows Apple's online orders for the last week. When shoppers place an online order, several "recommended products" (upsells) are shown as at checkout an attempt to upsell See table 2 in cell...

-

The following information was drawn from the balance sheets of the Augusta and Reno Companies: Required a. Compute the current ratio for each company. b. Which company has the greater likelihood of...

-

The following information is available for three companies: Required a. Determine the annual before-tax interest cost for each company in dollars. b. Determine the annual after-tax interest cost for...

-

Buoy manufactures flotation vests in Charleston, South Carolina. Buoys contribution margin income statement for the month ended December 31, 2014, contains the following data: Suppose Overboard...

-

An employer has calculated the following amounts for an employee during the last week of June 2021. Gross Wages $1,800.00 Income Taxes $414.00 Canada Pension Plan $94.00 Employment Insurance $28.00...

-

Section Two: CASE ANALYSIS (Marks: 5) Please read the following case and answer the two questions given at the end of the case. Zara's Competitive Advantage Fashion houses such as Armani and Gucci...

-

The activity of carbon in liquid iron-carbon alloys is determined by equilibration of CO/CO2 gas mixtures with the melt. Experimentally at PT = 1 atm, and 1560C (1833 K) the equilibrated gas...

-

Apply knowledge of concepts and theories covered in the course to leader - the leader can either be themselves if they lead a team, someone real and personally known to them (such as a boss or leader...

-

A resistor in a dc circuit R = 1.2 2. The power dissipated P is a second-degree function of the voltage V. Graph P versus V from V = 0.0 V to V = 3.0 V.

-

Solve the inequality in terms of intervals and illustrate the solution set on the real number line. 2x 2 + x 1

-

Extend Algorithms 3.4 and 3.5 to include as output the first and second derivatives of the spline at the nodes.

-

The following events apply to Kate Enterprises: 1. Collected $16,200 cash for services to be performed in the future. 2. Acquired $50,000 cash from the issue of common stock. 3. Paid salaries to...

-

Presented here is selected information from the 2018 fiscal-year 10-K reports of four companies. The four companies, in alphabetical order, are: AT&T, Inc., a company that provides communications and...

-

Presented as follows are 12 financial ratios for two companies in the sane industry. Colgate-Palmolive Co. (Colgate) and Procter & Gamble Co. (P&G). Both of these companies sell health, beauty, and...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App