The following financial information is taken from the annual reports of the Billy Company and the Ball

Question:

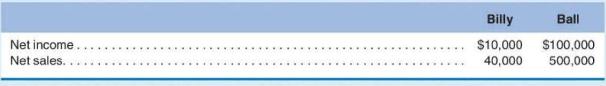

The following financial information is taken from the annual reports of the Billy Company and the Ball Company:

Calculate the return on sales ratio for each company and determine which firm is more profitable.

Transcribed Image Text:

Billy Ball Net income.. Net sales... $10,000 $100,000 500,000 40,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Based on the table Billy Company has a higher return on sales ratio than Ball Company To calculate the return on sales ratio divide the net income by ...View the full answer

Answered By

Shubhradeep Maity

I am an experienced and talented freelance writer passionate about creating high-quality content. I have over five years of experience working in the field and have collaborated with several renowned companies and clients in the SaaS industry.

At Herman LLC, an online collective of writers, I generated 1,000+ views on my content and created journal content for 100+ clients on finance topics. My efforts led to a 60% increase in customer engagement for finance clients through revamping website pages and email interaction.

Previously, at Gerhold, a data management platform using blockchain, I wrote and published over 50 articles on topics such as Business Finance, Scalability, and Financial Security. I managed four writing projects concurrently and increased the average salary per page from $4 to $7 in three months.

In my previous role at Bernier, I created content for 40+ clients within the finance industry, increasing sales by up to 40%.

I am an accomplished writer with a track record of delivering high-quality content on time and within budget. I am dedicated to helping my clients achieve their goals and providing exceptional results.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Evaluating Firm Profitability The following financial information is taken from the annual reports of the Smith Company and the Wesson Company: Smith Wesson Net income $20,000 $180,000 Net sales...

-

The incredible growth of Amazon.com has put fear into the hearts of traditional retailers. Amazon.coms stock price has soared to amazing levels. However, it is often pointed out in the financial...

-

P6-45. Interpreting Accounts Receivable and Uncollectible Accounts Mattel, Inc. designs, manufactures, and markets a broad variety of toy products worldwide which are sold to its customers and...

-

Find the inverse function f -1 of function f. Find the range of f and the domain and range of f -1 . 2 S(x) = 2 cos(3x + 2): sxs+ 3

-

The compound 1,1,1-trifl uoroacetylacetone (tfa) is a bidentate ligand: It forms a tetrahedral complex with Be2+ and a square planar complex with Cu2+. Draw structures of these complex ions and...

-

Read carefully Section 9. 4 of the textbook before making any effort to respond to this question. Since the signing of the 1992 Framework Convention on Climate Change at the Earth Summit in Rio de...

-

On August 1, George Bell Company paid $8,400 in advance for 2 years insurance coverage. Prepare Bells August 1 journal entry and the annual adjusting entry on December 31.

-

Follow the instructions preceding Problem 9.57. Write the audit approach section following the cases in the chapter. The following is an excerpt from an article, Memory Chip Trader Gets 14 Years for...

-

17 19 Part 3 (16 points) 20 Payroll data for the employees of Apple Co. this week is as follows: Federal Year to Date Gross Pay Gross Pay Income Tax As of the week before this week Employee This Week...

-

The following financial information is taken from the balance sheets of the Peter Company and the Paul Company: Calculate the current ratio for each company and determine which firm has the higher...

-

Desi Company, a merchandising firm, reports the following data as of January 31,2019 Prepare a classified balance sheet for Desi Company as of January 31, 2019. Stockholders' equity.... Property,...

-

The accounting records of Pacer Foods Inc. include the following items at December 31, 2014. Requirements 1. Show how each relevant item would be reported on the Pacer Foods Inc. classified balance...

-

Boomtown is preparing a cost analysis of the three departments: Parks. Fire, and Water. To comply with accuracy standards in allocating indirect costs, Boomtown will employ the step-down method of...

-

Listed in the accompanying table are waiting times (seconds) of observed cars at a Delaware inspection station. The data from two waiting lines are real observations, and the data from the sir line...

-

Franklin Prepared Foods (FPF) sells three varieties of microwaveable meals with the following prices and costs: Variable Cost Fixed Cost per Meat Fish Vegetarian Entire firm Selling Price per Case: $...

-

Isabella is a 14-year-old Hispanic bisexual female who has come into the Department of Child Safety (DCS) care due to neglect. Isabella's mother, Martina, is 35 years old, a single mother, has an...

-

Jeff is able to ride a bicycle although he hasn't ridden one for a few years, thanks to his: ( A ) procedural memory ( B ) episodic memory C ) semantic memory ( D ) cognitive memory

-

As competition for a scarcer dollar increases, an increasing number of companies are taking action by fostering customer-centric cultures that enhance satisfaction and drive bottom-line...

-

Represent each of the following combination of units in the correct SI form using an appropriate prefix: (a) m/ms, (b) k m, (c) k s /mg, and (d) k m N.

-

A bond issued on February 1, 2004 with face value of $35800 has semiannual coupons of 6.5%, and can be redeemed for par (face value) on February 1, 2025. What is the accrued interest and the market...

-

Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the...

-

The local supermarket is considering investing in or Checkout kioske for its customers. The wol-checkout kiosks will cost $47.000 and have no residual van Management expects the equipment to rest in...

Study smarter with the SolutionInn App