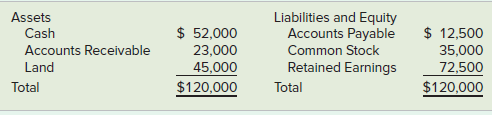

Waddell Company had the following balances in its accounting records as of December 31, Year 1: The

Question:

Waddell Company had the following balances in its accounting records as of December 31, Year 1:

The following accounting events apply to Waddell Company’s Year 2 fiscal year:

Jan. 1 Acquired $35,000 cash from the issue of common stock.

Mar. 1 Paid a $4,000 cash dividend to the stockholders.

April 1 Purchased additional land that cost $20,000 cash.

May 1 Made a cash payment on accounts payable of $7,000.

Sept. 1 Sold land for $25,000 cash that had originally cost $25,000.

Dec. 31 Earned $65,000 of service revenue on account during the year.

31 Received cash collections from accounts receivable amounting to $55,000.

31 Incurred other operating expenses on account during the year that amounted to $34,000.

31 The land purchased on April 1 had a market value of $30,000.

Required

Based on the preceding information, answer the following questions for Waddell Company. All questions pertain to the Year 2 financial statements.

a. What amount would Waddell report for land on the balance sheet?

b. What amount of net cash flow from operating activities would be reported on the statement of cash flows?

c. What amount of total liabilities would be reported on the balance sheet?

d. What amount of net cash flow from investing activities would be reported on the statement of cash flows?

e. What amount of total expenses would be reported on the income statement?

f. What amount of service revenue would be reported on the income statement?

g. What amount of cash flows from financing activities would be reported on the statement of cash flows?

h. What amount of net income would be reported on the income statement?

i. What amount of retained earnings would be reported on the balance sheet?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds