15. You are analyzing the cross-sectional variation in the number of financial analysts that follow a company

Question:

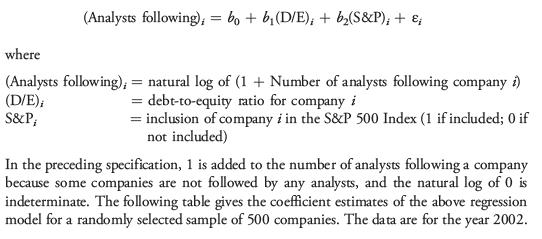

15. You are analyzing the cross-sectional variation in the number of financial analysts that follow a company (also the subject of Problems 3 and 8). You believe that there is less analyst following for companies with a greater debt-to-equity ratio and greater analyst following for companies included in the S&P 500 Index. Consistent with these beliefs, you estimate the following regression model.

You discuss your results with a colleague. She suggests that this regression specification may be erroneous, because analyst following is likely to be also related to the size of the company.

A. What is this problem called, and what are its consequences for regression analysis?

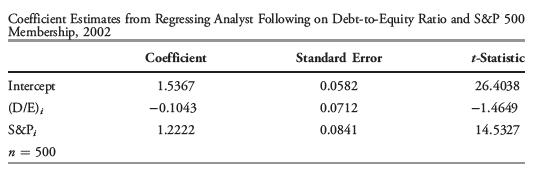

B. To investigate the issue raised by your colleague, you decide to collect data on company size also. You then estimate the model after including an additional variable, Size i, which is the natural log of the market capitalization of company i in millions of dollars. The following table gives the new coefficient estimates.

What do you conclude about the existence of the problem mentioned by your colleague in the original regression model you had estimated?

Step by Step Answer: