17. A client has a portfolio of common stocks and fixed-income instruments with a current value of...

Question:

17. A client has a portfolio of common stocks and fixed-income instruments with a current value of £1,350,000. She intends to liquidate £50,000 from the portfolio at the end of the year to purchase a partnership share in a business. Furthermore, the client would like to be able to withdraw the £50,000 without reducing the initial capital of

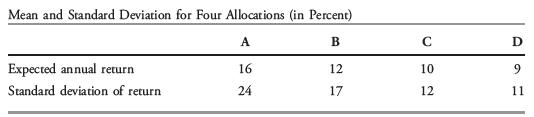

£1,350,000. The following table shows four alternative asset allocations.

Address the following questions (assume normality for Parts B and C):

A. Given the client’s desire not to invade the £1,350,000 principal, what is the shortfall level, RL? Use this shortfall level to answer Part B.

B. According to the safety-first criterion, which of the allocations is the best?

C. What is the probability that the return on the safety-first optimal portfolio will be less than the shortfall level, RL?

Step by Step Answer: