7. Both researchers and the popular press have discussed the question as to which of the two...

Question:

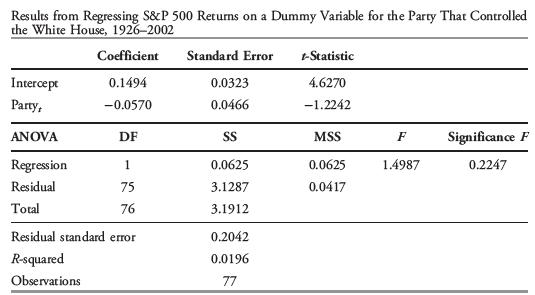

7. Both researchers and the popular press have discussed the question as to which of the two leading US political parties, Republicans or Democrats, is better for the stock market.

A. Write a regression equation to test whether overall market returns, as measured by the annual returns on the S&P 500 Index, tend to be higher when the Republicans or the Democrats control the White House. Use the notations below.

RMt ¼ return on the S&P 500 in period t Partyt ¼ the political party controlling the White House (1 for a Republican president; 0 for a Democratic president) in period t B. The table below shows the results of the linear regression from Part A using annual data for the S&P 500 and a dummy variable for the party that controlled the White House. The data are from 1926 to 2002.

Based on the coefficient and standard error estimates, verify to two decimal places the t-statistic for the coefficient on the dummy variable reported in the table.

C. Determine at the 0.05 significance level whether overall US equity market returns tend to differ depending on the political party controlling the White House.

Step by Step Answer: