ABP is a pension fund with approximately 2.6 million members. It manages a defined benefit scheme for

Question:

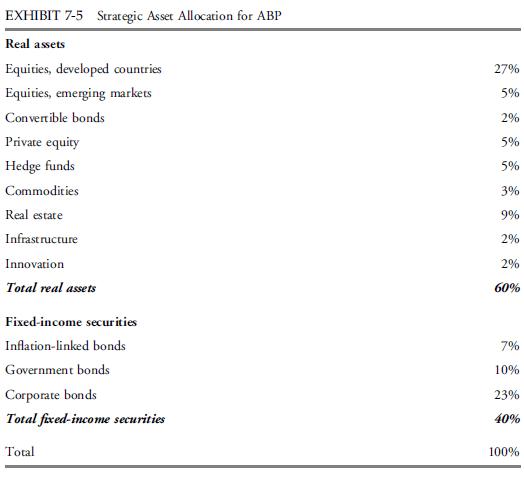

ABP is a pension fund with approximately 2.6 million members. It manages a defined benefit scheme for civil servants in the Netherlands, and its goal is to pay out a “real”

pension (i.e., one that will increase through time in line with consumer price inflation). With ₤173 billion under management at the end of 2008, ABP is one of the world’s largest pension funds. It decides on its asset allocation in an investment plan that is reviewed every three years. The asset class terminology used by ABP is distinctive.*

Exhibit 7-5 shows ABP’s SAA under the plan for 2007–2009.

1. Discuss the way the asset classes have been defined.

2. How does the asset allocation relate to the pension fund’s ambition to pay out a real (i.e., inflation-adjusted) pension?

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard