The strategic asset allocations of many institutional investors make a distinction between domestic equities and international equities,

Question:

The strategic asset allocations of many institutional investors make a distinction between domestic equities and international equities, or between developed market equities and emerging market equities. Often, equities are separated into different market capitalization brackets, resulting, for example, in an asset class such as domestic small-cap equity.

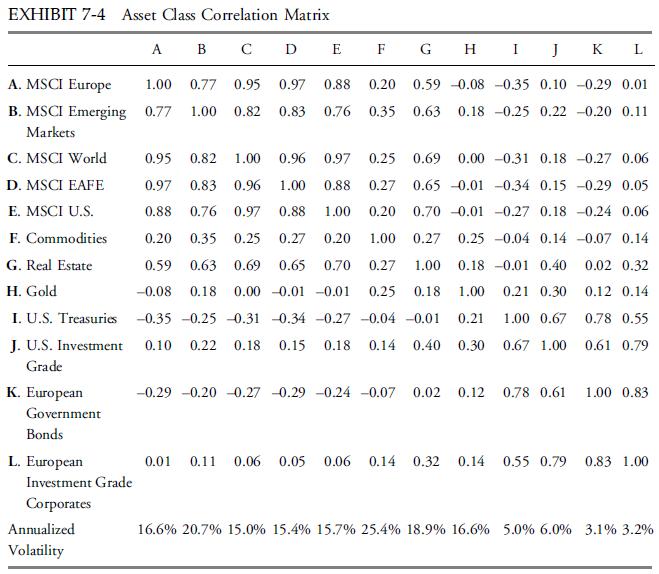

The correlation matrix in Exhibit 7-4 shows the paired correlations between different equity asset classes and other asset classes. These correlations are measured over 10 years of monthly returns through February 2009. In addition, the exhibit shows the annualized volatility of monthly returns.

Based only on the information given, address the following:

1. Contrast the correlations between equity asset classes with the correlations between equity asset classes and European government bonds.

2. Which equity asset class is most sharply distinguished from MSCI Europe?

Step by Step Answer:

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard