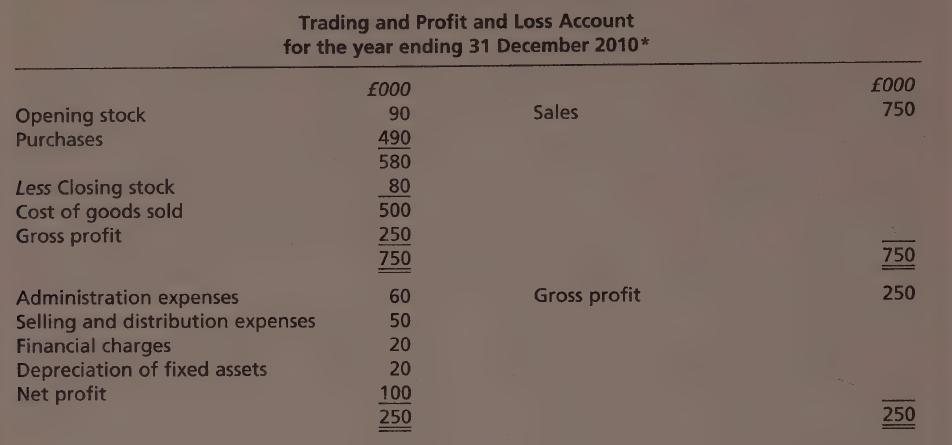

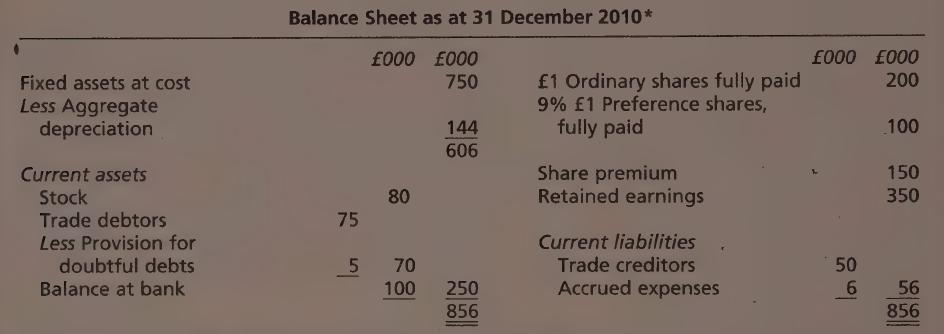

The following information has been extracted from the books of Issa Ltd for the financial year ended

Question:

The following information has been extracted from the books of Issa Ltd for the financial year ended 31 December 2010.

The company had commenced the preparation of its budget for the year ending 31 December 2011 and the following information is the basis of its forecast.

1 An intensive advertising campaign will be carried out in the first six months of 2011 at a cost of £15,000. It is anticipated that as a result of this, sales will increase to £900,000 in 2011.

2 The gross profit/sales ratio will be increased to 35 per cent.

3 A new stock control system is to be installed in 2011 and it is expected that the stock level will be reduced by £15,000 as compared to the 2010 closing stock.

4 Land and buildings which cost £50,000 (nil depreciation to date) will be sold in 2011 for £200,000 cash. Half of the proceeds will be used to buy ordinary shares in another company, Yates Ltd, at an agreed price of £4 per share. (Ignore share commission etc.)

5 The company planned to capitalise some of its reserves on 1 April 2011. New ordinary shares are to be issued on a 1 for 2 basis. Half the funds required will be drawn from the share premium account and the remainder will be taken from retained earnings.

6 Preference share dividends will be paid on 1 May 2011 and 1 November 2011. The company planned to pay an interim ordinary share dividend on the increased share capital of 2.5p per share on 1 July 2011. No final dividend is proposed.

7 Owing to inflation revenue expenses are expected to rise as follows:

Administration expenses will increase by 6 per cent.

Selling and distribution expenses will increase by 8 per cent.

The advertising campaign expenses are in addition to the increase above.

Financial charges will increase by 4 per cent.

These percentage increases are based on the figures for the year ended 31 December 2010.

8 With the projected sales increases trade debtors are expected to rise to £100,000 by 31 December 2011. The provision for doubtful debts is to be adjusted to 7'/2 per cent of forecast trade debtors.

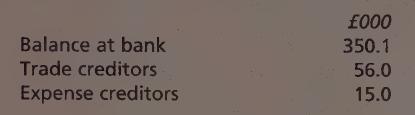

9 Other forecast figures as at 31 December 2011.

10 Depreciation of 10 per cent per annum on cost is to be provided on £600,000 of the company’s non-current assets.

Required:

(a) A budgeted trading and profit and loss account for the year ending 31 December 2011.

Show the full details of the trading account. Show the appropriations of retained profits in a note.

(b) A budgeted balance sheet as at 31 December 2011.

(c) What advantages accrue to a business by preparing a budget with respect to (i) forecast profitability;

(ii) forecast liquidity?

Step by Step Answer:

Business Accounting Uk Gaap Volume 2

ISBN: 9780273718802

1st Edition

Authors: Alan Sangster, Frank Wood