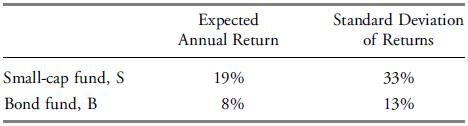

An investor is considering investing in a small-cap stock fund and a general bond fund. Their returns

Question:

An investor is considering investing in a small-cap stock fund and a general bond fund.

Their returns and standard deviations are given next and the correlation between the two fund returns is 0.10.

1. If the investor requires a portfolio return of 12 percent, what should the proportions in each fund be?

2. What is the standard deviation of the portfolio constructed in Part 1?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Principles Of Portfolio And Equity Analysis

ISBN: 9780470915806

1st Edition

Authors: Michael McMillan, Jerald E. Pinto, Wendy L. Pirie, Gerhard Van De Venter, Lawrence E. Kochard

Question Posted: