Aors portfolio allocation for Njau is most likely optimized on the basis of: A. a stated maximum

Question:

Açor’s portfolio allocation for Njau is most likely optimized on the basis of:

A. a stated maximum level of volatility.

B. total portfolio mean–variance efficiency.

C. the results of the risk tolerance questionnaire.

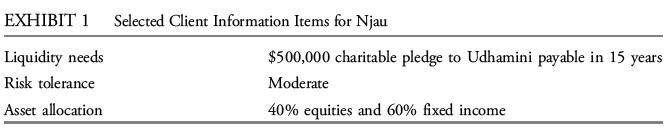

Noèmie Açor works for an international bank as a private wealth adviser. Açor speaks several regional languages in addition to her native language. She prepares for two client meetings next week. First, Açor will meet with Winifred Njau, who has recently retired. Njau has made a charitable pledge to a non-profit university endowment, the Udhamini Fund. Açor prepares a draft of the investment objectives section of an investment policy statement (IPS) for Njau using selected client information, which is presented in Exhibit 1.

Açor’s notes from her previous meeting with Njau indicate the following behavioral considerations related to Njau’s retirement planning:

• Njau would like to increase her level of spending if supported by investment projections.

• Although Njau could pay a lump sum and receive a series of fixed payments, she prefers not to lose control over her assets.

• Njau understands the risk–return relationship and is willing to accept some short-term losses to achieve long-term growth.

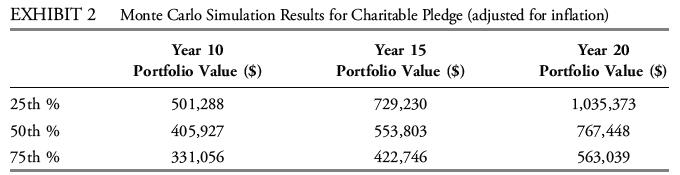

Next, Açor reviews a recent risk tolerance questionnaire completed by Njau, which relates to overall portfolio risk. Açor focuses on the type of capital sufficiency analysis to perform for Njau. To determine the optimal allocation, Açor seeks to ensure that Njau’s charitable pledge can be met and implements a goal-based investing approach. Açor runs a Monte Carlo simulation to determine the probability of success, which is the likelihood that Njau can meet her charitable pledge objective. The simulation results are presented in Exhibit 2.

One week after this meeting, the bank sends a client satisfaction survey to Njau. In response to questions about Açor’s soft skills and technical skills, Njau responds with the following comments:

Comment 1: Açor constructed a portfolio that is appropriate for my unique situation.

Comment 2: Açor spoke to me in my own regional language throughout the meeting.

Comment 3: Açor educated me about how my investments perform and affect my portfolio.

Açor’s second meeting will be with Thanh Bañuq. Bañuq is Njau’s nephew and serves on the board of directors of Udhamini. Açor obtained the essential facts about Bañuq when she opened his account, including his risk and return objectives and the origin of his wealth. In preparation for the meeting, Açor considers the high level of taxes that Bañuq pays. Açor will recommend changing the asset location of high-dividend-paying equities that Bañuq owns from a taxable account to a retirement account with tax-free earnings and withdrawals.

During their meeting, Açor and Bañuq discuss charitable pledges that Udhamini has recently received and the likelihood that Njau will meet her charitable pledge. Bañuq then asks Açor the following question:

“How might my investment objectives and constraints differ from those of a typical university endowment, such as Udhamini?

The day after Açor’s meeting with Bañuq, Açor realizes that her actions in the meeting may have raised an ethical concern.

Step by Step Answer: