Based on its HHI, the initial US large-cap benchmark most likely has: A. a concentration level of

Question:

Based on its HHI, the initial US large-cap benchmark most likely has:

A. a concentration level of 4.29.

B. an effective number of stocks of approximately 35.

C. individual stocks held in approximately equal weights.

The Mackenzie Education Foundation funds educational projects in a four-state region of the United States. Because of the investment portfolio’s poor benchmark-relative returns, the foundation’s board of directors hired a consultant, Stacy McMahon, to analyze performance and provide recommendations.

McMahon meets with Autumn Laubach, the foundation’s executive director, to review the existing asset allocation strategy. Laubach believes the portfolio’s underperformance is attributable to the equity holdings, which are allocated 55% to a US large-capitalization index fund, 30% to an actively managed US small-cap fund, and 15% to an actively managed developed international fund.

Laubach states that the board is interested in following a passive approach for some or all of the equity allocation. In addition, the board is open to approaches that could generate returns in excess of the benchmark for part of the equity allocation. McMahon suggests that the board consider following a passive factor-based momentum strategy for the allocation to international stocks.

McMahon observes that the benchmark used for the US large-cap equity component is a price-weighted index containing 150 stocks. The benchmark’s Herfindahl–Hirschman Index (HHI) is 0.0286.

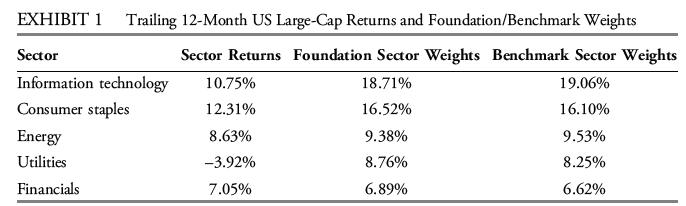

McMahon performs a sector attribution analysis based on Exhibit 1 to explain the largecap portfolio’s underperformance relative to the benchmark.

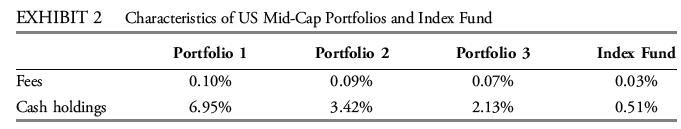

The board decides to consider adding a mid-cap manager. McMahon presents candidates for the mid-cap portfolio. Exhibit 2 provides fees and cash holdings for three portfolios and an index fund.

Step by Step Answer: