Determine the most appropriate currency management strategy for Bhatt. Justify your response. Following analysis of Indian economic

Question:

Determine the most appropriate currency management strategy for Bhatt. Justify your response.

Following analysis of Indian economic fundamentals, C&M’s currency team expects continued stability in interest rate and inflation rate differentials between the United States and India. C&M’s currency team strongly believes the US dollar will appreciate relative to the Indian rupee.

C&M would like to exploit the perceived alpha opportunity using forward contracts on the USD10,000,000 Bhatt portfolio.

Mason Darden is an adviser at Colgate & McIntire (C&M), managing large-cap global equity separate accounts. C&M’s investment process restricts portfolio positions to companies based in the United States, Japan, and the eurozone. All C&M clients are US-domiciled, with client reporting in US dollars.

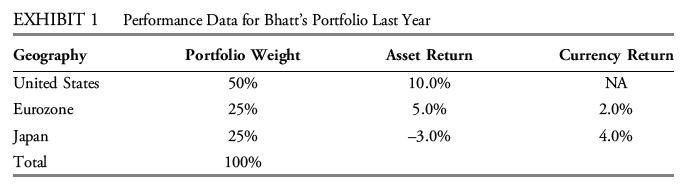

Darden manages Ravi Bhatt’s account, which had a total (US dollar) return of 7.0% last year. Darden must assess the contribution of foreign currency to the account’s total return.

Exhibit 1 summarizes the account’s geographic portfolio weights, asset returns, and currency returns for last year.

Step by Step Answer: