Calculate the contribution of foreign currency to the Bhatt accounts total return. Show your calculations. Darden meets

Question:

Calculate the contribution of foreign currency to the Bhatt account’s total return. Show your calculations.

Darden meets with Bhatt and learns that Bhatt will be moving back to his home country of India next month to resume working as a commodity trader. Bhatt is concerned about a possible US recession. His investment policy statement (IPS) allows for flexibility in managing currency risk. Overall returns can be enhanced by capturing opportunities between the US dollar and the Indian rupee (INR) within a range of plus or minus 25% from the neutral position using forward contracts on the currency pair. C&M has a currency overlay team that can appropriately manage currency risk for Bhatt’s portfolio.

Mason Darden is an adviser at Colgate & McIntire (C&M), managing large-cap global equity separate accounts. C&M’s investment process restricts portfolio positions to companies based in the United States, Japan, and the eurozone. All C&M clients are US-domiciled, with client reporting in US dollars.

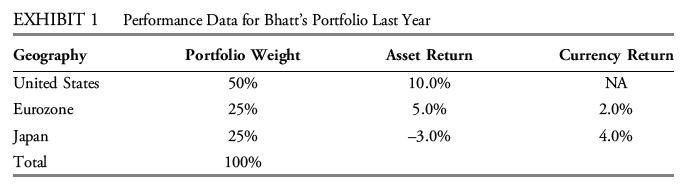

Darden manages Ravi Bhatt’s account, which had a total (US dollar) return of 7.0% last year. Darden must assess the contribution of foreign currency to the account’s total return.

Exhibit 1 summarizes the account’s geographic portfolio weights, asset returns, and currency returns for last year.

Step by Step Answer: